Portfolio Review - January 2022

I don't wanna play with you anymore - Jerome to growth stocks & crypto

Equity Portfolio Breakdown

Green: Value as % of my portfolio

Orange: Cost as a % of my total cost invested into equities

This chart simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

*Raised cash this month & hence showing it as a % of my portfolio.

Equity Portfolio Performance

Time-weighted returns (IRR) - Past 12 months

Cumulative IRR returns

CAGR* Performance

Note: Brokerages and most investors use IRR (time-weighted returns) as a metric. A crude but also widely used measurement is CAGR, which is basically value as a % of cost, annualized (i.e. $1 invested at the start will be $x now). Given our monthly DCA strategy that isn’t as accurate.

In any case, it’s a good measure for non-investment savvy folks who just want to know how much money they take out vs they put in. Value over cost. My chart is an attempt to simulate this by using MoM returns of classic benchmarks to compound my cumulative additions into stock markets. I’m doing this bc investment calculators for NASDAQ & SP500 isn’t as accurate I would like them to have.

That’s more for my own analysis. You just need to know how underwater I am right now 😭😂

Equity Portfolio Changes

Added: $NET $SNOW $U $DDOG

Started: $TSLA

Trimmed: nil

Sold: $MP (for rebalancing into other stocks, not due to fundamentals)

Crypto Portfolio Performance*

* Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 10.5x-ed my cost

Lifetime result:

- Outperformed BTC by 2.02x (10.5/5.3)

- ETH outperformed me by 1.88x (18.5/9.8)

Goal is to try and outperform BTC and ETH from here on out. 👍🏻

% of Net Worth (direction change from previous month) in:

Stocks: 17.1% (🔼)

Crypto: 74.6% (🔽)

Net worth excludes fixed assets (e.g. house)

Portfolio Performance: TL;DR

Equities

Welcome to the start of the end. The bubble has definitively popped. The people left on FinTwit are: Puru Saxena (repeating that bubbles have popped & that DCA-ing over next 1-2 months will be good long-term IRR, all whilst sitting comfy in his hedge), Jim Cramer (advocating retail investors to buy $SARK which I’ll bet those plebs (including me) won’t even know the risk behind it), Chamath “below my line” Palihapitiya (don’t know the reference? See here) and Gary Black (wondering why $TSLA isn’t at his 6-12 months $1600 PT yet).

Some sell-side analyst from Bank of America just put out a note saying that they expect Fed to hike 7 times this year?! My portfolio is down 20% this month alone. Bubble does not seem like it is done deflating. Earnings for many of my portfolio companies (which are still relatively expensive) yet to come.

Wyd?

Bull markets teaches bad habits. Bear markets teaches good habits. Young investors (including me) gushing with the high-adrenaline of stock market pumps from 2020/21 sometimes forget that market cycles are ever present. Proudly claiming valuations doesn’t matter (as I once tweeted a long time ago) doesn’t make it irrelevant for the other investors. Indeed, valuations doesn’t matter until it does. Not even your beloved companies which will surely change the world.

While I’m happy to admit that valuations do matter, it’s an entirely different thing to use that as a starting point to evaluate any investment. In the near term, stock prices track investor’s sentiment about stocks and broader economic environment (macro). In the long-term, stock prices track intrinsic value pretty well. Pretty sure well-read investors can spot the reference to Benjamin Graham.

Anyway, here’s an example to put things in perspective. Here’s FinTwit darling $SE limited (with my buys overlaid w icons).

Market sentiment changes pretty damn fast these days. Taking the staircase up, then the elevator down. Ring any bells?

While we’re at it, let me show you my first mistake(s) of 2022:

Well, I actually did have a limit order at $150. I think at that time it only dropped to $180 and then a short squeeze rallied the price up to $206, before dumping Forrest Li and his band of 兄弟 into oblivion (now at $124 as of 28th Jan). You can’t catch them all… right? Fears of FF growth stagnating + broad recovery of economy (i.e. less ecommerce boom) + rate hikes make up the holy trinity that finally brought this goliath to its knees.

Any further movements on this stock can only be evaluated during its Q4/FY21 earnings. For me, I am currently balls deep and will probably add to it (if I even have the spare cash) if it dips below $100 or $80. Will I blink again? Find out in next month’s article.

To add salt to my wound, my first $TSLA purchase was at $1144 on 3rd Jan 2022. Talk about timing. There were many instances where I pondered over selling this share (& incurring fees) and then buying lower. Being honest here, I think my ego got in the way. I was only thinking how selling now would somehow make me a more discretionary trader (aka like Puru who has high portfolio turnover) which isn’t necessarily my long-term investing objective (which is to buy good companies and hold for the long-term).

Reality happened. I would have been able to buy $300 dollars lower ($TSLA went briefly below $800 as of 28th Jan). I would also have been able to fill my limit order of $850. But, I blinked. This journal serves as a historical account, as well as my reflection. If prices moon from here, it’ll be my mistake to bear. Otherwise, it’ll be a lucky opportunity. Also as $TSLA briefly dipped below $800, should I have added another share? Or should I have waited?

Again, only time will tell.

Mistakes define who you are. Only you can decide whether to let the mistakes destroy you, or to make you stronger. Like they say, pain only makes you stronger.

I’m in Spain without the s… 😤

The market conditions serves as a timely reminder for you to assess how emotional you are from such market gyrations. Are you sleeping well at night? How do you feel when you look at your portfolio or check market prices? Do you feel uneasy? When you see jokes being made on FinTwit about your precious stocks, do you feel anger? Do you feel like replying in the heat of the moment?

If you generally feel downcast (or worse) when markets are having a bad day, perhaps it’s time to consider a different investment strategy (or maybe you’re investing too much without a safety net). If its sound and long-term in time horizon, pretty likely you’ll beat inflation (and then some).

$VOO (Vanguard S&P 500), $QQQ (NASDAQ) or even one of those MSCI world indices can offer great returns (relative term) without the emotional burden of active portfolio management. Especially with routine DCA, I think you’ll beat most of retail active investors. Active investing requires time & effort, both of which are in finite amounts.

For me, I’ll give it my all for the next 5 - 10 years in both stocks and crypto. At some point in the future, I’d have to square with myself if my performances underperform the benchmark. If I can’t outperform, I’ll simply be a passive investoooor and that should also free up more time for me to spend with my family (would have had kids by then 🤩).

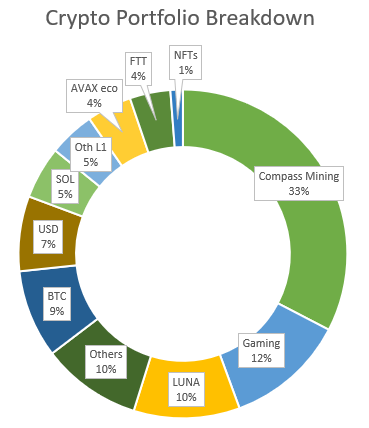

Crypto portfolio commentary

My crypto performance chart looked like it held up well in the face of altcoin obliteration but that was thanks to my CapEx into compass mining (more on that below), which I’ve valued at historical cost basis (paid about 7.7k USD/miner back in Jul/Aug 2021). That has become my main position as shown below:

I’ve made quite a fair bit of changes to my portfolio. I’ll go through my thought process behind the main changes, which were influenced by the broader macro economy (i.e. rate hikes and quantitative tightening) as well as a shift into the P2P kind of investor mentality as opposed to P2E. Let me explain P2E > P2P.

During 2020 and 2021, what got BTC to 65k was the influx of capital from retail and institutions. Even in 2020 there was only ETH for DeFi, SOL came later in the year. Then came AVAX and LUNA with anchor protocol. In 2021 the Fed put was still there. Money was dropped from helicopters (aka government). People had money but nowhere to put it. Capital flows further and further out onto the risk spectrum. Everything has gone up during that period.

P2E: Just like MMORPG games, you hunt monsters which are often too easy to kill. Without doing much, you can get an easy 2-5x. See $SOL in 2021 for a perfect example.

It’s a > 1 ratio between capital inflow and capital required by crypto.

Fast forward to end of 2021 and 2022. I’ve lost count in how many Olympus-DAO forks exist right now. How many variations of Ape NFTs are in existence (and which are the authentic ones)? How many wannabe OpenSea competitors airdropped tokens to OpenSea users trying to conduct vampire attacks on OpenSea? How many GameFi tokens raised money via the IDO wanting to be the next AAA game on the blockchain? How many alt L1s can we do our DeFi business on?

There’s no kind way to put it. Current # of projects that demand investor’s attention > amount of capital inflows into the space. It has become a rotatoooors game now, trying to find the next niche or retail trap project that will turn into a winner. Related, great read below.

Hence, with the MMORPG example, now you are fighting against other players. Should you choose the wrong project to ape into (i.e. $TIME with the Sifu fiasco), your rebased token will become worthless faster than the rebasing period itself. We are all trying to spot the rotation and profit from it. Thus more effort is needed to actively read and hunt for the projects under the radar. Much more difficult than waiting for monsters to come.

Solana

Solana, for the better part of 2021, was the largest spot position in my portfolio. Everything seems so much clearer in hindsight but there were calls for Solana to hit $400, $500 per token at its ATH of $250. It takes a bear market to really understand cycles and how reflexive things can be. It dropped to a YTD low of $82. Now at $90+.

I sold my first stacks (which I held throughout H2 2021) of SOL in the $160 price, then subsequently more and more. While the fundamental thesis hasn’t changed (which is to be institutional grade NASDAQ in the blockchain space), the macro sentiment weighed quite heavily in my mind (as explained above). Retail flows had also exited the building for 2022. It also didn’t help that Solana had network issues that occurred during a crash which made DeFi activity like liquidations much more painful. It’s worth noting that ETH doesn’t get congested bc you just pay higher fees. Solana has constant fees, so throughput is constantly stressed and it proved to be too much in recent weeks.

Right now, it’s also just 1 of many alt L1s that can potentially onboard the next million users into crypto (though have seen encouraging signs from it’s mobile phantom wallet). In light of this, I took some profits on the way down and rebalanced accordingly into other alt L1s like Harmony One (more on this later), Fantom and NEAR.

In reflecting over this rebalancing, something kept resurfacing in my mind:

Unrealized gains are not the same as profits.

What’s the point of sitting on a mountain of unrealized gains? Especially when crypto is such a volatile and reflexive asset; prices moon and crash all in a span of 1-2 months. By the way, I’m still working a full-time job. I’m still in the G in WAGMI.

Hodling for the long-term is a sure way of turning into a bag holder in an industry where solutions from 2018 are nearly extinct and irrelevant. My rebalancing into other alt L1s is a bet on the future where users don’t really know (or care) which chain they are on. In the back-end, the protocols do all the necessary bridging for them. All will grow, and some will grow faster. I am no oracle, so my strategy is more of an index play, weighted based on my conviction.

To be transparent, my alt L1 positions (in order of size from biggest in mcap):

LUNA > SOL > AVAX (incl XAVA/JOE) > FTM > ETH > NEAR > ONE

LUNA has an added catalyst in UST which I think deserves a higher allocation in the alt L1 play.

* Added ETH as a benchmark and hence will denominate more in ETH (+ owning more ETH through my crypto plays).

Olympus DAO forks

While the $TIME craze had warped into hyper drive with Dani of Frog Nation, I too had been over exuberant with other such forks, putting about 1k into another similar protocol Snowbank ($SB). I think this month has brought such rebasing tokens into the forefront of CT and exposed a huge blind spot. How authentic is 80,000% APY? We aren’t ALL going to be millionaires for sure, so what will give way? Price did. I bought my first chunk of TIME back in the 4k to 6k region. End up selling it all at 2k. For SB, I was lucky enough to escape with only a small loss.

In essence, such protocols require constant inflows into their treasury to offset the expansion in supply from the rebasing. At the height of this craze, many protocols were valued at a multiple of their risk-free value (which should exclude their own token e.g. TIME). As price cratered towards 1x multiple a negative feedback loop ensued. TIME (or wMEMO or wonderful memories) is now valued at ~$500. More like worse memories.

Notably, near to the end of Jan, it turns out that 0xSifu (CFO of wonderland’s treasury) was actually a co-founder of QuadrigaCX which collapsed after the founder ran away with the money. Very bad look for Daniele & co. Related threads here and here.

I am thankful that I sold before it cratered. Suffice to say I’ve experimented enough with such tokens to know that it’s a Ponzi scheme (though we can say that for all of crypto).

Gaming

I also want to clarify my position/perspective on gaming tokens. Generally speaking there are 2 main categories: Pure play gaming tokens ($AXS $PYR $JEWEL) and gaming guild tokens ($YGG $MC). Within the former category, you have some games with an inflationary token (i.e. $SLP for Axie, $ATLAS for Star Atlas) that is designed to support in-game activity & mimic real world economies with the assumption of linear game activity growth over time. You have other games that require their base token (e.g. $JEWEL) to perform actions in the game such as summoning heroes.

I remain very bullish on GameFi as I think it’s ties in very well with the gamer community at large (especially in 3rd world countries w/o 1st world country’s work opportunities).

People spend hours on end on Twitch looking at eSports athletes play their favorite games like CSGO, PUBG or League of Legends. eSports championships has already reached many million viewers. A sure sign of things to come as more and more teenagers get onboarded onto games (as they naturally do).

The base assumption is that there exists a generation of global gamers often daydreaming about making a living out of gaming. Imagine such a user earning above minimum wage in their local town whose median income is below the poverty line, all from their mobile phone?

Take that and merge GameFi (i.e. play-to-earn) + scholars (i.e. getting capital upfront to play the game; rewards split between guild and yourself). The end result is (hopefully) a self-sustaining ecosystem of guilds earning yields from scholars + scholars themselves playing to actually better their real lives in the real world though the rewards earned (which can be sold for USD). It’s already happening with Axie and people in the Philippines, and that imo was a successful experiment of retail/global adoption which I think bodes extremely well for the future of blockchain gaming.

The latter category is gaming guild tokens. It’s still a nascent space, many guilds like Yield Guild Games, Merit Circle, Rainmaker Games, Metaverse Mining Alliance have just raised funds via a pre/public sale of their tokens. Everything seems rosy and these guilds/platforms are also aggressively onboarding scholars and games to earn more yield. Price should moon, right?

What’s the catch?

Token emissions. See the below:

Just see the gradient of the slope. Also side note: seems like all the guilds decided that their max tokens should be 1 billion? lol.

Anyway, you can see why the gradient is important. You, a loyal supporter of the GameFi space, also bought into the LBPs on Balancer protocol for these gaming guild tokens. Without doing anything, your token will get massively diluted (about 1/8 to 1/9 in proportion of supply) by the end of the emissions curve (~3-4 years); Correspondingly, supply will roughly 8-9x.

In such cases, you are often forced to accept some Impermanent Loss (IL) to get the highest yield via LP on your existing spot tokens (by locking it up for 1 year) just to stay ahead of inflation. This is the catch. In a bull market we are none the wiser and as long as price goes up, we’re close one eye on this. But in a bear market, as price crashes + your token is diluted (due to selling pressure from unlocked tokens), how much further can your token price crash?

Answer: another 99%.

Of course, I hope it doesn’t turn out this way. I’m already in both LP and staked positions for 12 months to earn the highest yields. For me, while the trend is likely to be down (assuming no new retail inflows etc. and no positive catalysts), it is unlikely I can time the bottom with great accuracy (though it may just be an accumulation range). The optimistic side of me thinks that in 1 year my cost basis will have dropped substantially (from the farmed tokens) and that the market price will be higher from where it is now.

We’ll see. If it’s materializes, then good. Otherwise, I’ll move on. Everything is a bet & we can’t win them all.

TL;DR: Gaming tokens have higher upside but requires more effort to evaluate each game - which one will be the next Axie, gaming guild tokens requires demand & inflows to offset dilution.

Other activities

During the month, I’ve also bought and sold some stuff because I was experimenting with the ecosystem. I’ll also try to highlight some to share the extent of my experimentation in the various ecosystems to highlight some protocols in case you’re curious.

Yield Guild Games: Sold. For the reason described above in the gaming section + for the fact that it is bigger in mcap. I rebalanced into other related plays like JEWEL and PYR.

Octopus Network: A infrastructure play. Basically it’s a blockchain-as-a-service, allowing dapps to spin up their own blockchains while Octopus handles the infra and necessary inter-chain communication with larger chains. Am holding spot tokens on my NEAR wallet (can buy via Ref Finance). Watch this video (founder of OCT) to learn more.

Pocket Network (POKT): Similar infrastructure play. Pocket Network wants to be the TCP/IP protocol for the Web3 infrastructure. Read Ansem’s Substack to find out more. Currently staking my tokens with Poktpool which allows for fractional staking.

GenesysGo (SHDW): Similar to Pocket Network but primarily focused on the Solana blockchain. Currently lending my spot tokens on Francium for yield.

Platypus Finance: This protocol is a stablecoin farm based on the voted escrowed token model. Essentially you lock up your tokens for voting power and the proportion of voting power vs total will correspond to your farm apr. If you don’t continuously stake those earned PTP tokens (you earn PTP by farming PTP/AVAX or by putting stables into the farms with PTP staked) for vePTP, your proportion will slowly reduce which will also reduce your APR. You will never be able to beat whales that have bots that do the compounding for you. So you’re already a non-winner, and that’s before the emissions (PTP/AVAX was yielding 500%+ APR at some point) dilute your holdings further. Sold at about 50% loss, though am still linearly vesting PTP tokens (which I will sell) on a monthly basis up till EOY 2022 from Avalanche’s launchpad.

Etherprint: I’ve only got a small bag (relative to my portfolio) as a degen play. It’s a token that has no utility (as far as I can tell). Buying ETHP requires the buyer to pay x% in taxes. 5% was paid in Ethereum to existing holders. 2% to operations, 1% to marketing. Previously I think the refractions paid to existing holders was in the teens. This is essentially earning yield on volume. If volume is low and there’s only sell pressure, unlikely your price depreciation will be offset by refractions earned. Sold at a small loss.

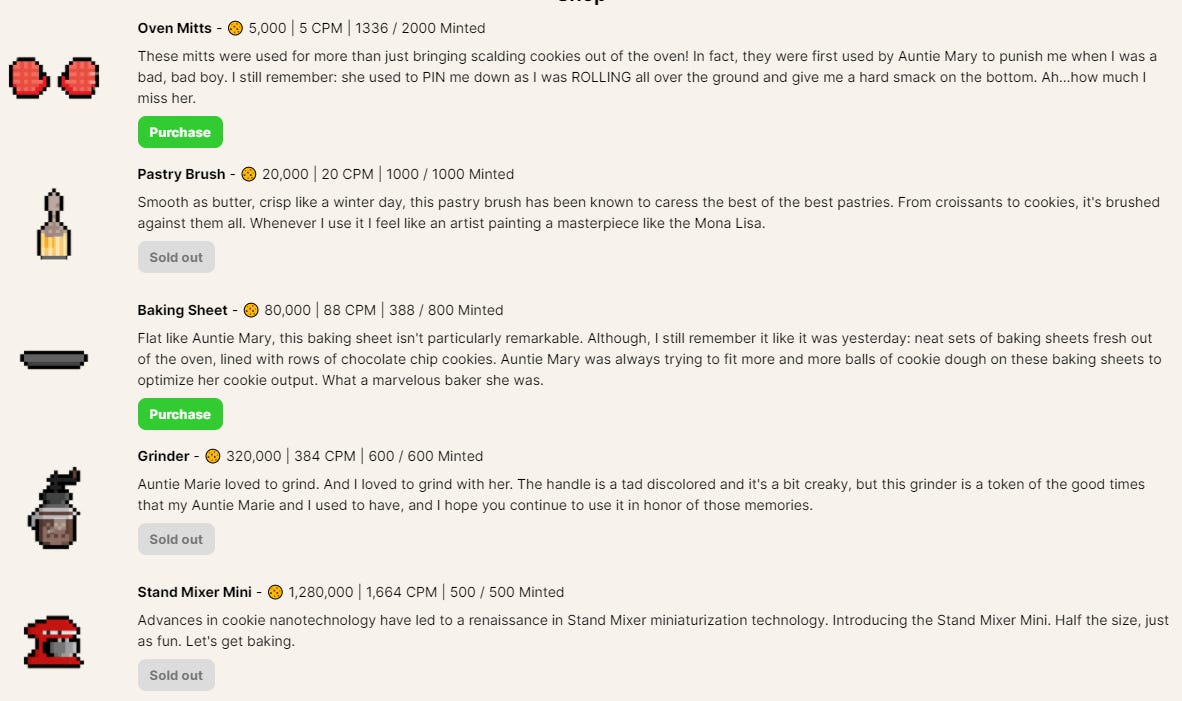

Cookie Game: A perfect example of Ponzi scheme. Note that I do not recommend anybody to buy NFTs of this game. Essentially, users first buy NFTs of bakers to bake cookies. From these earned cookies, they can be used to buy upgrades that improve the cookies per minute generated from your account. It doesn’t take long for the early adopter with loads of cash to win the game by simply buying the most OP item there is: Stand Mixer. Once the first user buys the stand mixer they can mint another mixer in 769 minutes or 12.8 hours (1.28 mil / 1664 / 60 minutes). The next mixer can be minted in half that time. Within 1 day the user can already mint 5, and it won’t be long until he/she mint them all.

Does it smell like cookies or ponzi’s in here?

The real cost here is the price paid (in AVAX) to mint the original baker NFTs. This project is a real piece of work. Experiment complete. 🤢

This is not an exhaustive list.

Compass Mining

I earlier remarked in my December article that running a miner is actually not as easy as setting up the rig and running the program. What is your program fails? Are you tech savvy enough to troubleshoot? What if your miner requires maintenance? How do you prevent it from overheating?

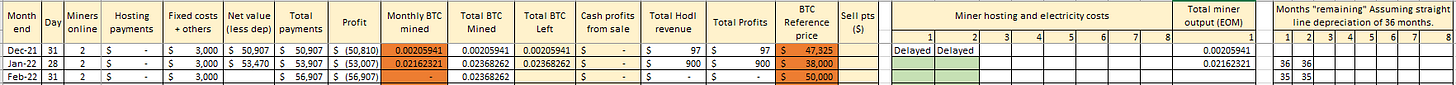

Times like these I’m glad I’ve got Compass Mining handling all of these for me. It’s been a sweet, sweet month mining more satoshis, but as with any endeavor, it has its ups and downs. I had 2 miners online from late December, but around early-mid Jan, 1 of them started going off and on. After several intermittent hashing periods (on off for a few hours), it finally flat-lined on 13th Jan. About 24 hours later, I emailed support. They said they will check with the ops team onsite.

After 4 more days, no word. I asked again. They said they will get back to me. After few more days, I asked. They said that the miner is in the troubleshooting queue. After a few more days (i.e. 30th night local time), my miner finally came back online 🎉🎉

17 days of missed satoshis… No matter, at least the miner isn’t down and requires replacement of parts from BitMain themselves (which will take super long with shipping).

Anyway, this is just one of the problems you will face as you host your own rig (either via compass or at home). It’s not all smooth sailing, and with my problematic miner, how do you do technical troubleshooting? For now, I’m a happy customer of Compass Mining, and have just paid my second instalment of a mini-VIP bundle of another 6 miners, each of which should come online by mid-March (2 weeks delay due to logistics) then 1 month thereafter.

I am unlikely to purchase more miners unless the cost per miner drops sufficiently enough to make economical sense. That said, I think these 8 miners will mine me sufficient satoshis over their lifetime to deploy into other protocols, raise cash or just stack sat.

Here’s my miner tables that I created to track my outputs. About 0.025 in total since starting in late Dec + 1 miner offline for 17 days. Can’t complain eh? As mentioned in my previous article, due to delays, my miners’ hosting fees are waived for the first 12 months (hence the green cells in 2nd table). Hope this helps inform people on the economics of BTC mining.

Just as I thought lady luck shined on me, the same miner went offline after 24 hours… Owning miners is not easy.

Token holdings

Last but not least, my holdings not in order of size, degen plays (if any) excluded:

L1s: LUNA SOL AVAX (incl. XAVA JOE) FTM ONE NEAR

Gaming: MC RAIN JEWEL PYR MMA (presale tokens)

Infrastructure: SHDW POKT OCT RNDR HNT

Large caps: BTC ETH

Others: BASIS SD

Hedging

I’ve put this section separate as I think it applies to both equities and stocks. Hedging offers a peace of mind for investors looking to protect their downside in times of volatility. Like with every product with returns, there are risks. Essentially, we need to get a few things right (get some answers) before hedging can be successful.

What is the indicator or trigger that will allow you to open/close your hedging position?

Have you back-tested the strategy over prior timeframes (2-5 years for crypto, 10-20 years for equities)? What is the eventual performance over time (fees included)?

Is there a way to automate such a strategy via your brokerage of crypto CEX?

Other factors include costs, available collateral (i.e. cash to repay any losses if position is closed at a loss) and the representative asset that is the closest proxy to your portfolio. It’s not rocket science for sure, but its definitely not easy to create one, much less execute it (without human biases) in reality.

I am nowhere near being able to consistently deploy hedging due to the cash requirements. Given the value of my portfolio, a 10% drop (if due to automatic trigger to close position) would result in a decent sized loss (relative to my current salary) which I have to repay. Being unable to pay would risk me losing my stocks as they would need to liquidate it to satisfy my debt obligations.

It’s also partly a consequence of my brokerage platform which still charges ~4.7 USD per order which adds unfavorably to my hedging cost requirements (switching costs to another brokerage w cheaper fees are also cost-prohibitive, believe me I’ve checked). Hedging, for now, is a rich man’s hobby and is not suitable for us retail plebs, especially since we’ve been utterly smacked by the Fed this month.

Down bad, no money to add to dips of all stocks, no money to hedge. All the while market will tank without warning.

While there are workarounds for this (i.e. you can short equities on the crypto side via FTX or other DeFi means), there is a considerable amount of friction to do that which will disrupt my current DeFi plans. Though, FTX’s QuantZone (which is automated) would remove a huge logistical burden because US markets open at 1030 PM local time. This is definitely something that requires deeper research and testing.

On the crypto side, I wonder if my hedging strategy will naturally default to simply take profits as opposed to shorting to obtain delta neutrality (i.e. no exposure to market direction risk). This will also require some form of automation as mentioned above. The thing that made me lean towards taking profits vs hedging is the reflexivity of this asset class. Markets can stay irrational longer than you can remain solvent. Hedging works best when trends are almost near their end. If you’ve opened a hedging position in $JEWEL when it was at $5, how many times will your automated stop loss be reached before price eventually floats back down?

Given the number of tokens I have, the best I can do is find a best approximation that represents my risk profile, which is likely Ethereum. Anyway, talk is cheap. Hedging isn’t. Now that market’s have royally f*cked us in the ass, my portfolio isn’t large enough to be rolling out a hedging strategy too. 😭

Let’s see how much effort I can put into this… Will report back in a few months. If you’re looking to do the same, you can look for inspiration here or hit me up in Twitter DMs. Let’s chat.

Life

In other news, I’ve been trying to switch into another career that is better suited for my skillset (data/business analytics) and I’m thankfully still sufficiently early in my career to explore a career change (current job is statistical compilation for economical statistics i.e. GDP) without a prohibitive cost on my family. One thing I didn’t expect was the amount of assessment (granted, the jobs asked for analytics e.g. Python experience). I was so swamped with assignments and found it quite tricky for some that I had to take leave just to have time to complete the assignments. Some part of me wonders if I’m competent enough to excel in the jobs that I’ve applied to.

During a conversation with my friend, we also talked about work life balance and how it’s serially underrated. Being honest, if not for work-life balance, my crypto knowledge and portfolio wouldn’t be where it’s at right now. I can’t imagine switching to a job requiring me to constantly OT and even work on weekends. How will I keep up with the crypto world? Crypto is by far the strongest contender in the list of [job, stocks, crypto] that will lead me (& my family) to financial freedom (not even kidding).

I summarized the outcome of our decision with a 3-choose-2 model much like most problems in life.

Work-life balance [X]

Nature of work (do you like the nature of work you’re doing) [Y]

Remuneration [Z]

It’s near impossible to optimize for all 3. Which one do you find most important in your life right now? My current job optimizes for X and Z. I’m hoping to shift from X to Y or Z to Y. Honestly I’m still trying to find my footing around work and crypto and don’t really have an end-game as to where I’ll end up for the remainder of my career.

There’s a lot of empty talk here, but only 1 thing matters. Whether I receive a job offer or not. If I don’t, none of this talk matters. Job hunting is honestly quite tiring, but it falls under the “If I don’t do it, I’ll regret it” category.

SBF

It seems that as the market took gains away from me, it gave me another gain in the form of a good queue number. For the uninitiated, public housing in Singapore is hot property; supply of flats (built and unbuilt) are released by governments every quarter. We applied for a town we thought we didn’t have much chance for ( was 10x oversubscribed) and we got it! If luck is on our side, we’ll be eyeing for units that already have keys available and we can begin the renovation process right away. Fingers crossed on getting a good unit.

Excited for what’s to come both in life, work and crypto. Very exciting times, 2022. Bring it on. 👍🏻

Low key praying for crypto markets to be good to me so I don’t have to worry about the debt…

Conclusion

Thank you for reading thus far. I do apologize for ranting in the articles I’ve written (like this one), and I acknowledge that it could have been more concise. I’m still only 11 months (wow) old in my writing pursuit. Hopefully I’ll evolve into a better writer (and thinker) in the future.

In the meantime, if you learned something from my journal, or if you have any strong comments, feel free to let me know :)

Your words of appreciation (currently measured in article views) means a lot to me. Thank you again.

Happy Chinese New Year! 🧧🧧 💰💰

Joey