Equity Portfolio Breakdown

Blue: Current value as % of my portfolio

Orange: Cost as a % of my total cost invested into equities

No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them. This chart simply visualises the divergence between my investment thesis and the current market expectations of the company.

*Raised cash this month & hence showing it as a % of my portfolio.

Equity Portfolio Performance

Time-weighted returns (IRR)

CAGR* Performance

*Note: Brokerages and most investors use IRR (time-weighted returns) as that is what most platforms provide. Practically speaking though, you’d want to know what 1$ of your investment (if all invested since inception) will be worth today. It’s a crude metric, but to everyday people, this is more relatable (since if I liquidated my $1 portfolio right now, I’d get $1.XX over my total cost invested).

Getting massacred over here.

IRR stats

Portfolio Changes:

Bought: $ROKU $CRWD $TDOC

Crypto Portfolio 2021 Performance*

* For this year end, the above chart shows the YTD performance. The start of the charts are indexed to one, showing how much my net worth (at the start of 2021) would be in 3 separate baskets:

In terms of my own holdings (blue)

All into BTC (orange)

All into ETH (grey).

End of year is my performance against the benchmark. This is different than what is shown in the prior month. Portfolio performance from start 2020 (indexed to 1):

Recall that the last time I’ve added IRL money into crypto was in July 2020. But, I only started tracking my net worth in December 2020. Hence, best to bring everything to the start of 2020. Summarizing:

2020 performance: 2.73x-ed my portfolio

2021 performance: 5.46x-ed my portfolio

Lifetime (from Jan 2020) performance: 14.89x-ed my portfolio

Lifetime result: outperformed BTC by 124.8%, ETH outperformed me by 89.2%.

Goal is to continually outperform BTC and ETH from here on out. 👍🏻

% of Net Worth (exclude fixed assets) in:

Stocks: 18%

Crypto: 76%

A Word

December is a special month. It’s the only month where you are more likely to reflect on the past 11 months. As they say, the final hour (month) is always important. What lessons have I learnt this year? What have I done right? What have I done wrong? What can I improve on next year?

For my earliest friends who’ve read my monthly article from Feb 2021 (oh how time flies), thank you. While the original intention of this article was simply to be transparent, it has evolved to more of a online journal for my monthly self reflection exercise. This came in handy this month as I need only read my articles to reflect on the past year.

I also didn’t intend to have 100 views of my November 2021 writeup. That is a heartwarming achievement that I genuinely appreciate. It brings a smile to my face that there are people willing to join me in my investing journey. 🙂

Again, thank you.

December is a good a time as any to reflect and prepare for the oncoming 2022, I’d like to do a special edition of this monthly writeup. I will read through what I’ve posted for each month in 2021 as well as my investment decisions (have tracked each purchase and holdings across crypto and stocks).

The reflection will be posted separately as another article. Keep a lookout on my Substack page (or your inbox if you subscribed) for it (titled Lessons of 2021). I wanted to do this to evaluate my past thought processes and decisions. In doing so, I learn and improve.

My long-term investment objective remains the same:

Achieved outsized returns over the long-term.

To do that, I need to put in more effort than the average investor. Plain and simple.

Nothing in life matters more than the effort you put into pursuits you genuinely care about.

Stocks portfolio commentary

Depending on which stocks (indices or high growth stocks) you own, December will save or kill your portfolio YTD performance.

Markets doesn’t move in a straight line, but boy do they give you a run for your money. The first half of December (unsurprisingly before the 15th Dec FED FOMC meeting) was marked by heavy corrections in growth stocks. Some part of it were due to the overextension from frothy valuations. The other part was the broader market fear that the FED is too conservative with its tapering plan (due to sky-rocketing inflation).

I tweeted some time ago that I had a wish list of stocks I wanted to add to (having removed the more speculative positions in my portfolio $DNA $LMND $NVTA) in a defensive response. I’m happy to say that some of the orders have been hit (though was a consequence of my slightly moving up my orders). Funny how FOMO played a part in this. I was so certain that price will go down to my limit orders. I played blink with Mr. Market and I blinked first.

Investing is NOT easy, amirite?

Elsewhere I also wanted to start a $TSLA position at $850 (my brokerage can’t buy fractional shares). Price dropped to $886 as Elon Musk was selling his shares and funds were front-running. It is now $1056 (Dec 31st) per share. This time I didn’t blink. But I didn’t manage to start that position as price never hit my limit order. That was frustrating. We don’t always get what we want; That’s OK, but we need to learn from any mistakes that could’ve prevented us from doing so.

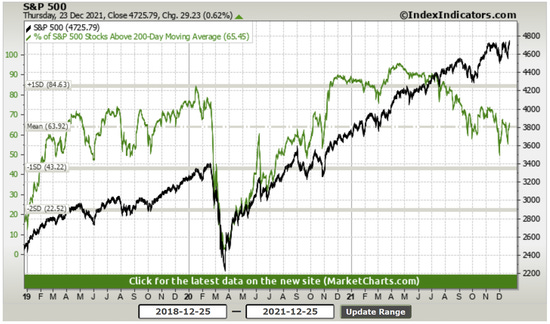

Markets then proceeded to go green from the crash earlier in the month. S&P made a new ATH as many of its constituents were already below their 200DMA.

The market leaders are supporting the market right now via the market-cap weighted price performance. Can we expect them to roll over? Unsure. Will they continue to new ATHs while the rest of the market languishes near its 200DMA? Unsure. Will FED being more aggressive with its tapering/hiking change anything in terms of stock prices, given that the market may have priced it in? Unsure.

Nobody knows for certain what will happen to the markets, obviously. The important point (which I’ve struggled) is how prepared are we for the different scenarios?

Let’s pretend we’re not “sophisticated” investors like many FinTwit gurus and we don’t yet know how to hedge our portfolios. Like me, we’re all mostly newer investors that started in 2020 and much of our success came from the out-of-this-world (to the moon 🚀) bull market from March 2020 onwards that brought many X’s to our beloved stocks. Here are some classic examples:

If the market (market here refers to all your portfolio stocks) falls by 20% but does so over 2 weeks. After that is clear skies for 2022. What is your plan? Do you have a plan to add or increase exposure?

If the market doesn’t correct 20%, and instead only corrects 10% in a day every 20% up. This means that the next correction happens at 120%, dropping prices to 108%. Will you (or can you) add exposure at 108%? Or will you ride the wave?

If the market falls by 20%, but then rallies 25%, but drops 30%, would you have bought during the first fall or the last fall? What if the 30% drop happened only during March 2022 (i.e. markets will be ranging from 80% of current price to 100% until March 2022)?

What you do depends on a few factors. Your cash position, your future contributions, your current stock exposure, your buy list and your view of what the company may look like in 1-2 years.

For me, I realized that having a cash position, while not totally enjoyable as you’ve got cash on the sidelines as everything else rallies, helps me sleep better at night. It’s not rational for sure. Based on hindsight, my cash would have been better deployed in $TSLA and other stocks earlier in December.

Though, hindsight is quite dangerous for investing, no?

If only I had known…

Looking forward, the cash position, while <10% of my total portfolio value, will probably come in handy in the future if there’s an extended correction. If that doesn’t materialize, I still have 90%+ of my stock exposure and will still benefit if stocks resume their journey to the moon.

I’d say that covers me pretty well for the situations I talked about.

What about you? Are you prepared for *any* scenarios?

Thoughts on 2022

For equities, I don’t expect another trip to the moon in 2022. Active investing is never easy. It’s just the perfect storm of macro conditions, combined with a tsunami of liquidity (thank you, Fed) that resulted in the 2020-present bull market.

I don’t have a clue what will happen next year. Hikes or withdrawal of liquidity can go brought forward (or not), and that will certainly wreak havoc on markets. Being so aggressive with dips during 2020 and 2021, I think it’s time for me to slowly ride this wave, being more defensive and conservative with my buys.

My core holdings will still be there, but I’ll only add to positions if opportunities allow for it. Every quarter, I will evaluate the company performance and depending on the stock’s reaction post earnings, I may add further. Bull or bear, I will still continue reading and learning about these companies which I hope to have a long-term position in to grow together with the business execution.

I’ll still likely underperform the indices in 2022 (and/or also in 2023), but that’s fine by me. Success in the stock markets are measured over 5 to 10 year periods. Best to keep learning, buy or increase ownership in great companies, and own them for a very long time.

Crypto portfolio commentary

Crypto was lightly massacred as inflation fears in the legacy markets also spilled into the crypto space via risk-off sentiment. I use the term lightly because it wasn’t a full blown bear market (more like consolidation and painful ranging). Having periodically updating my net worth tracker (2-3 times a month) I am thankful that the value of my holdings are only slightly negative from November.

Still am beating BTC though… but still underperforming ETH (from Jan 2020, see my crypto chart at the top of article). The self consolation though is that I know lots more about the crypto space (compared to if I had just held ETH).

Was it worth it? Yes it definitely was.

The added knowledge will build the base for more profits in the future, for sure.

Before I continue any further on my commentary, I’d like to flag some wonderful articles I’ve read over this month to you.

All you need on Crypto’s 2022 outlook.

Cobie’s article on trading the metagame. He’s probably the warren buffet of the crypto space, having been early and survived long enough to become stupendously rich. I put him together with the likes of Zhu Su as god-tier traders. His Substack here has 4 other equally great articles. I would recommend you to read all of them.

The bullish thesis for GameFi.

The post speaks for itself. Many things to learn, and it’s daunting to learn it on your own. This helps.

Crypto moves so fast man. To be honest, even GameFi wasn’t a thing until Axie Infinity took off in 2021. In 2020 perhaps the term didn’t even exist. Now it’s probably 7-9 on my bullishness scale, depending on which projects you talk about. An excessive amount of gaming guilds (YGG, MC, AAG, any so many more) sprung up.

Bullish.

Ok, back to my portfolio commentary.

Compared to previous months though, my portfolio changed quite a bit. The key changes were:

Trimmed half my FTT position. I am quite bullish on FTX as a whole, but perhaps I’ve overestimated the value accrual mechanism (i.e. buy-and-burn + fee rebates) and its effect on price. My remaining position is staked in FTX to enable 3 free ERC-20 withdrawals a day, amongst other benefits. I probably won’t sell it anytime soon.

I trimmed a small portion of my SOL holdings and other speculative assets thereby raising cash as a mental sedative. Helps me sleep at night. I doubled down on my existing narratives, including SoLunAvax (i.e. Avax). I also added exposure for some gaming tokens ($PYR, $JEWEL, $RAIN).

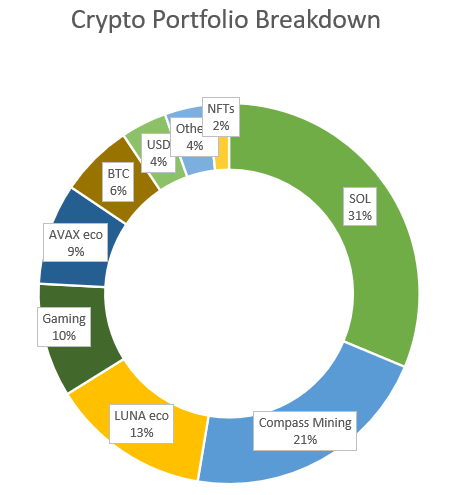

My portfolio breakdown below:

For transparency, my main spot holdings are shown here. Degen plays (or spot holdings with negligible size) are excluded. The list is not in order of size.

Alternative L1s: $SOL $LUNA $AVAX

Gaming: $MC $PYR $YGG $JEWEL $RAIN

AVAX eco: $JOE $XAVA $TIME

Others: $FTT $BTC $BASIS

From my holdings above you can see the type of narrative I’m putting my money behind. Gaming is the 2nd largest narrative based on my cost (& value). At the same time, there were some other tokens that caught my eye. Having bought them higher up in November, I capitulated like the paper handed investor I am, lol.

I had bought Arweave ($AR) and Render Token ($RNDR) earlier as I found their project has real-world utility. Arweave is a play on NFT storage, while Render is a play on decentralized compute (i.e. you use $RNDR to pay for compute power for rendering tasks). My cost basis for $AR was ~$62, and for $RNDR it was ~$4.6. I capitulated $AR at low $40s and $RNDR around $3.6. While the intention was for me to raise cash, man the timing could not have been worse. $AR went back to $60+ and $RNDR went to $6+ before coming back down (now $4+).

This is something quite frustrating as this isn’t the first time it happened. Reflecting on this, I am inclined to think that my paper-handedness came from not understanding the projects well enough, or not having enough conviction. The 2 projects could be a good long-term play, but perhaps I should concentrate on things/narrative I have higher conviction in, as represented in my spot holdings.

Before I move onto my yield farm developments, I’d like to share a small part about $BASIS. It’s related to a protocol that offers yields that are delta-neutral (i.e. delta 1). This means that the yields are unrelated to the price of the underlying asset. This project is co-founded by someone I quite respect, Traderskew (aka Adam Webb). Much of what I learnt in DeFi, especially in terms of yield farming came from his videos (only accessible to those that purchased it before, sorry!). In his biography he states that he was a market-maker in legacy markets, so I can understand and appreciate his emphasis on delta-neutrality.

Let’s face it: crypto prices won’t perpetually go on a 20% CAGR for 10 years straight. I mean, it will, but its near impossible to sit on a 10 year winner in crypto, outside of Bitcoin. Crypto’s reflexivity means that big boom-bust cycles (like bubbles) are extremely common. My next phase of the crypto journey (assuming I am able to reach that phase) involves relying lesser from directional movements (i.e. finding the next 10x) and more from delta-neutral yield. A simple example to illustrate:

Assuming a token A/USDC pool yields 200% APY. You could short an equivalent amount of token A on e.g., FTX. If price drops, you benefit from shorting, and can ‘add’ those profits to the LP farm which has suffered an impermanent loss. Safe to say, I am quite impressed with his teachings. I have also paid for a seat in the CryptoDesk OG discord (which is where I learnt about leveraged yield farming). I think the alpha inside the discord has more than paid for my entry fee.

In any case, the $BASIS position is equal parts backing the founder, and the longer-term value accrual from that project. If interested, read here. Not financial advice.

The potential bull-bear situations you need to think deeper about & evaluate them against your need for cash for the short-term. The interplay between the potential bull-bear and your financial predicament will determine your crypto strategy and whether you want to be adventurous or not.

This project is unlikely to be familiar to most crypto investors. Here’s the thing. The world moves fast. Crypto moves way faster. The circle of competence based on your research 1 year ago bears little relevance now. If left idle, your circle will start shrinking. Best to adopt an aggressive learning attitude, be nimble, and don’t hesitate to try. If you do all that, maybe (just maybe) you can expand your circle (and your net worth) over time. ;)

DeFi Movements

Ok, this section will be a big one. I’ve made quite a few changes on the DeFi side. Like prior months, I will just lay out my current DeFi activities.

Solana

I am involved in 2 protocols mainly. Francium and Solend. Solend is a protocol to lend and borrow assets. I’ve plugged my spare BTC and USD there to earn some yield (emissions from protocol tokens are still ongoing). Lend APYs are auto-compounded directly. Francium does the same, but it’s main purpose is to provide leveraged yield farming services.

Before you over-estimate the risk on Francium, note that you can do normal yield farming there (just use 1x leverage) as well. I supply my $SOL holdings there for some yield (your supplied assets are loaned to borrowers that do leveraged yield farming). My loaned SOL is earning 10% yield. I am also separately farming SOL/USDC on 2x leverage, the borrowed asset bring USDC.

There is no protocol token for Francium; your lend APY rewards are auto-compounded. The farming is currently yielding less than 50% APR, but since it’s auto-compounded, I am hoping to recoup some of the SOL tokens I sold off over the next year. In any case, it’s better than letting it sit idle, … right?

Another small portion of SOL was deposited into Katana, which is a protocol providing income generating products in the form of covered calls. Their docs can be found here. I have also done something similar for a portion of my BTC being lent on Solend, but with Friktion, which tbh has a better UI and smoother experience. The vaults on Friktion were actually full, which is why I went to the vaults at Katana.

Having consulted with my “options” friend, this strategy is indeed income generating, but the best conditions to do so are when markets are ranging or bear markets. The options cycle run for 7 days, so at the end of each cycle you can withdraw or roll your tokens for the next cycle. I am not as comfortable with this type of income (yet), so will see how it goes and will take it out if I feel the risk/reward isn’t in my favor.

AVAX

I am still running the launchpad strategy here, where you stake $XAVA tokens (albeit trimmed 25% of my $XAVA stack) for a guaranteed allocation to IDOs listed via the launchpad. Whilst the projects’ ROI have been significantly reduced (by way of people knowing about this strategy), it is still providing me an opportunity to add profits to my $AVAX stack. The latest IDOs there have linear vesting periods, but usually 20-40% can be sold off as a first tranche, just a day or two after the IDO ends. There’s where I usually just convert the tokens into $AVAX, just as a strict take-profit rule. The rest, I’m happy to just let it ride, or to use it for experimenting with the protocol itself.

Note that while the allocation looks good on the surface, the actual allocated amount for you to purchase is often $50 or less. Hence, even with a 5x, that’s only $350. Not complaining though, will run this strategy till it’s not profitable anymore.

The next one is $JOE, which seems to have a higher amount of users on its DEX than the DeFi giants $UNI and $SUSHI. I have quite a big bag of $JOE, and am doing the usual strategy of staking all $JOE into xJOE here, then farming it here. I believe in its value accrual and the positive effects on fundamentals in the long-term. Will just be patiently farming to ride it out to the next cycle.

Lastly, I have a $TIME position which I’m also staking to earn 69,000% in yield (aka 690x). Instead of explaining why or how $TIME’s yields are so sustainable, I will instead point you to this well written article by @SatoshiAlien about it. #FROGNation can sometimes be a force of nature. I have a $SB (which is also an Olympus-DAO fork like $TIME) position but that is just 30% of my $TIME position. Position sizing is key to risk management.

LUNA

I have some spare UST deposited in Anchor’s savings product here, as well as borrowed UST too for that sweet 19.5% APY. A simple thread on why it can achieve 19.5% APY here, and here. The borrowed UST comes from the collateral I’ve put in, which is bLUNA. Read the docs for more info. I’ve got another LUNA bag in Stader Labs for staking which is auto-compounded.

Even with the introduction of Risk Harbor (aka insurance for your anchor aUST peg), it’s not a full-fledged DeFi ecosystem like Solana (imo). Happy to experiment with more protocols as they get built out over the coming months.

Others

Funny thing, all my other DeFi farming activities not classified by a single ecosystem are gaming based. The tokens in question are $JEWEL $MC and $RAIN.

$MC and $RAIN aren’t pure gaming plays. Merit Circle ($MC) is a gaming guild that wants to recruit players to participate in P2E games. They’ve got (or are going to procure) a collection of in-game NFTs to rent out to scholars to participate in this game. The money earned is split between the player and MC itself (for loaning the NFTs or bootstrapping the player). There are other similar guilds like $YGG that operate on slightly different DAO structures.

Rainmaker Games however is (imo) more broad-based and is a larger play on the entire GameFi ecosystem. It seeks to build out a platform that can partner players to suitable guilds, and to onboard games to create a budding ecosystem of games, gamers, and guilds. Look at their docs for more information. It remains to be seen if values will accrue to $RAIN or not.

$JEWEL is the in-game token of DeFi Kingdoms on the Harmony One blockchain. I think its resiliency in terms of game volumes and player activity are fundamental strengths that investors in GameFi must not overlook. Furthermore, they are announcing an expansion to the $AVAX ecosystem by end of Q1. That would be quite bullish if player momentum picks up there significantly.

The points below outline how I’m earning yield on some of the gaming tokens i have.

Merit Circle: I’m staking my $MC tokens, locking it up for 52 weeks to get the highest weight (and staking APR). Supply of tokens will increase over the next year, so if you are leaving your tokens idle it’s hard to fight the supply increase (which will have downward pressure on price). There’s actually no reason to leave your coins idle.

Rainmaker Games: I’m staking part of $RAIN, similar to $MC, but also doing LP on RAIN-ETH. Current APRs on $RAIN staking is 350% (before locking), and 1.9k% on the LP. I expect the yields to float down significantly as news of such yields travel very fast + consensus narrative amongst crypto folk.

DeFi Kingdoms: I’m doing JEWEL-UST LP farming for about 500% APR right now, harvesting 2x a day. I expect yields to decrease linearly so perhaps over next 6 months (their liquidity rewards stop at around July 2022) I may enjoy a 100-150% annualized APR in sum, which isn’t all that bad to be honest. I also have another JEWEL bag that is staked as xJEWEL in the game’s bank. This is in preparation for DFK’s expansion into the Avalanche ecosystem.

Like I said, I’m pretty bullish on GameFi. Hard to fight against probably 1 billion + humans that grew up playing games. Now you can earn money playing games? Bro sign me up. Perhaps someday I might retire and just play games to earn my income and then stream it on Twitch or something… lol.

In my dreams.

Compass Mining

Guess what? Somebody’s started to hash!

Quoting my girlfriend, the miners have started digging. Excited to at least have some sort of passive income. In any case, while the idea of having passive income by mining the oldest digital asset out there is tempting, mining bitcoin is quite a different ballgame compared to say buying BTC outright.

There’s a lot of variables and uncertainty. For example, my miners ordered on July 24 and 27 via Compass Mining were originally scheduled for End-Sept and End-Oct. The miners only came online in 27/28 December. The 2 months of delay equates to around $2k USD? of income that is pushed back. The longer it takes to start mining, the lower % of the proportionate compute power you own, and the lesser you have (assuming new miners are always coming online).

Thankfully for me, I bought it at the depths of the BTC bear market as BTC went 30k. So I got my miners cheap. Delays also meant more credits and hosting fee waiver for me (by Compass Mining, not obligated to do so). Now if you check the compass mining website, miners are going for 13k a pop. That’s not a great look especially in terms of the miners’ economics (aka $ mined per TH) and their cost-benefit. Of course, please DYOR.

I have 6 more miners (also bought in July) coming online each month from next year Q2 to Q3-end, so I expect my BTC stack to grow consistently over the next year. Have also not decided my take profits on the BTC income stream. Perhaps 25% to USD now, and 50% to USD if BTC price is on the up? Not sure, but I’ll slowly figure it out over the next few months. The rewards aren’t yet considerable anyway, haha.

Thoughts on 2022

Like stocks, 2020 and 2021 saw a large swathe of people stuck at home via remote-work. Add to that helicopter money distributed by the government and not being able to spend on holidays or overseas trip. We now have huge amount of cash ready to participate in the worlds’ greatest 24/7 casino, cryptocurrencies.

We don’t have that same condition in 2022, so first off, expectations must be tempered. Tokens like SOL did around a 100x, and that’s saying something for a project currently top 5 in market cap. Where retail inflows has slowed, I think institutional funds will take over. It’s hard to track, but perhaps it’s easier to guesstimate what they might want to own. I think narratives are a good way to think about these potential fund flows. We can’t also make the argument that we’re late because many of these funds are restricted to the heavyweights (BTC and ETH) and perhaps it takes time for those shackles to come off and for them to invest more liberally?

For example, a clear narrative on the horizon is ETH 2.0 and L2 scaling solutions. Adam’s 206-tweet (!) thread on his outperform list in 2022 provides a great guide on spotting such gems (and many more). The adjacent narrative to this is alt L1s, which have materialized over 2021 in the SoLunAvax trade. I am now a strong bag-holder (though earning yield), but my baggy senses tell me that there’s room for multiple winners in the future. These two narratives are constantly pushing and pulling fund flows in response to successes (or failure) in each narrative.

Another narrative is GameFi. IMO that’s something already quite prominent, but my current (personal) outlook on it is that more games (especially by Web2 gaming studios) will be made with crypto P2E elements, not less. That will go some way into converting gamers into gamers who also play to earn. Guilds will naturally suck up most of such in-game assets (NFTs) and rent them to scholars like for Axie-Infinity or Vulcan Forged. I expect more of the same.

There are many other narratives out there. Above all else, it pays to have an open mind and read voraciously. Buying ETH as a buy-and-hold investment will probably do you good, but have you even used ETH outside of centralized exchanges? The entire point of crypto is that anybody can try anything, from anywhere. It’s the self-sovereignty of your own actions (and money). Sometimes, it all changes with a simple step.

I’ve personally used ETH, SOL, LUNA, AVAX, and ONE. Next year, the list will continue to grow. Online research is one thing, but only by experimenting will you understand the true potential of some projects out there. Don’t be afraid to experiment, and sometimes we all need to lose (by experimenting and failing) before we can win bigly.

Conclusion

It has been a joy writing this monthly article since February of this year. This December article is one that I’ve enjoyed writing the most. I have no clue what 2022 will bring in terms of my portfolios, but this next year is a big one for me:

I am trying to get a new job more aligned with my expertise (data analytics)

I will propose to my girlfriend

I will purchase a flat with me and my girlfriend

I will need to settle renovation for my newly purchased flat

I will also need to plan for my marriage

All these in Singapore costs a ton of money. What’s the saying? Money can’t buy happiness? Yeah, it can’t, but it can surely buy me a peace of mind and less headaches. Let’s hope I’ve planned my expenses well such that I can leave my portfolios untouched. Would much rather have stable debt (and pay interest) than to be a forced seller (and forgo potential upside in mid to long-term).

Don’t need to get triggered, different strokes for different folks.

If our paths crossed in 2020 and 2021, thank you for adding perspective to my life. I hope I’ve added perspective to yours. Let’s keep learning and growing (both our knowledge and net worth). I’ll see you next year :)

Wishing you a joyous (and hopefully greener) 2022!

Cheers,

Joey