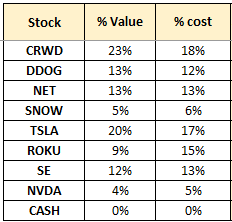

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total equity investment

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

Thanks for reading The Journey! Subscribe to receive new posts and support my work.

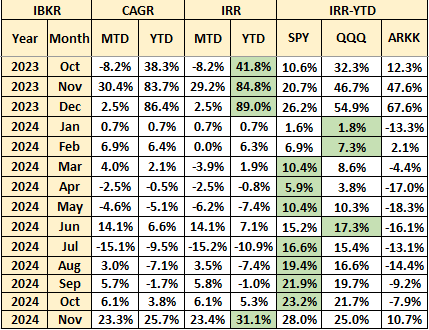

Equity Portfolio Performance

Historical Portfolio Returns (top); Cumulative Portfolio Returns (bottom) - Since new brokerage.

Monthly Portfolio Returns

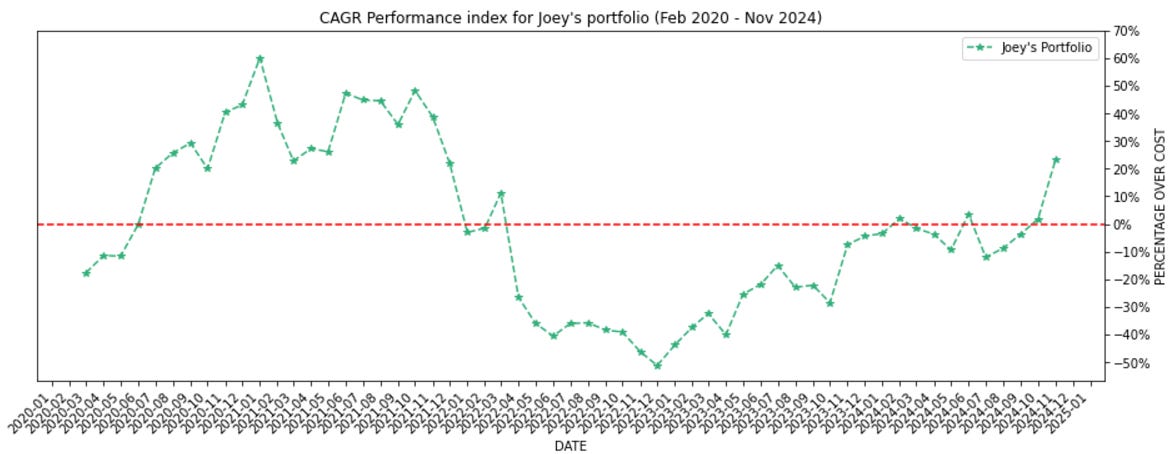

CAGR Performance

Note: CAGR for my portfolio is calculated as:

(market value of portfolio including cash / total cost) - 1

The CAGR returns are compared in the above table instead.

Crypto Portfolio Performance

Eth catching up…

* Chart starts from end of November 2020 when I started recording my crypto portfolio. Summarizing:

Lifetime performance since Nov 2020: ~27x my cost

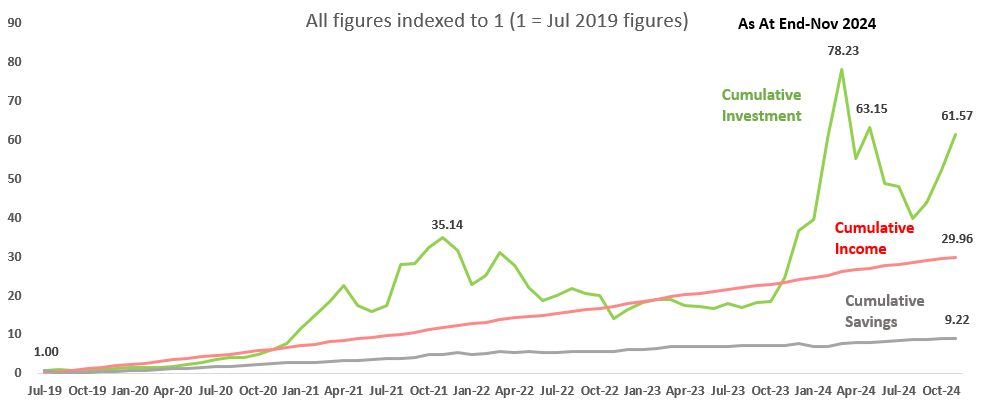

Net worth growth

If there’s only one metric that you can apply to your financial life, I believe that would be net worth. If you’re investing, perhaps under 5% of your gross income for investments, it’s a little hard (compounding considered) to eventually make a dent in your net worth.

To read this chart:

I’ve received ~30x my Jul 2019 net worth, in terms of income / bonus.

I’ve made my money work, and my net worth now is ~62x my Jul 2019 net worth.

I’ve accumulated savings of 9.2x my Jul 2019 net worth.

Red line is an extreme example; Anywhere between grey and red is acceptable, since you’re supposed to compound your savings, and not your income (i.e. you don’t spend anything). Onwards and upwards!

DCA Strategies

Endowus

Pretty good results since 2023, showing the true value of DCA.

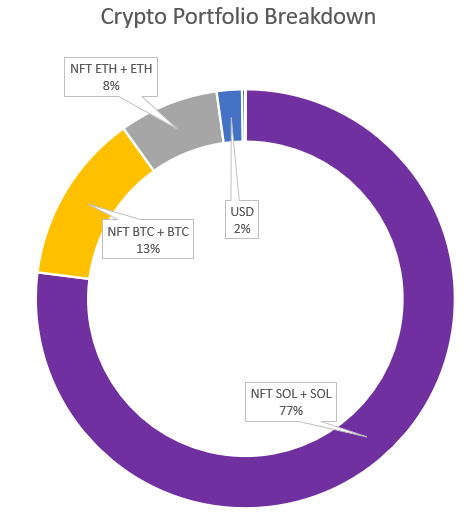

Crypto Portfolio

Conclusion

Thank you for reading November’s review.

The US election has brought about bountiful gains in both the stock and crypto markets, and I am cautiously optimistic that 2025 will bring event better results, especially in a rate-cut environment. Bitcoin would hopefully be a six-figure asset, which will surely capture the attention of the crowd to an even larger extent.

Don’t forget to rest up and think through how you’ll approach 2025, so that you’ll emerge stronger (and hopefully richer as well).

See you next month!

Joey