Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

Equity Portfolio Performance

Historical Portfolio Returns (top); Cumulative Portfolio Returns (bottom) - Since new brokerage.

Monthly Portfolio Returns

CAGR Performance

Note: CAGR for my portfolio is calculated as:

(market value of portfolio including cash / total cost) - 1

The CAGR returns are compared in the above table instead.

Crypto Portfolio Performance

* Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 6.336x my cost

Lifetime result:

- Achieved 1.68x of BTC performance (6.36/3.78)

- Achieved 0.45x of ETH performance (6.36/14.00)

Net worth growth

If there’s only one metric that you can apply to your financial life, I believe that would be net worth. If you’re investing, perhaps under 5% of your gross income for investments, it’s a little hard (compounding considered) to eventually make a dent in your net worth.

To read this chart:

I’ve received ~20x my Jul 2019 net worth, in terms of income / bonus.

I’ve made my money work, and my net worth now is ~17.4x my Jul 2019 net worth.

I’ve accumulated savings of 7x my Jul 2019 net worth.

Red line is an extreme example; Anywhere between grey and red is acceptable, since you’re supposed to compound your savings, and not your income (i.e. you don’t spend anything). Onwards and upwards!

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing below.

Equities Portfolio Commentary

5 Months into 2023, and it’s fair to say that we’re de-sensitised to rate hikes. Rates appear to be plateauing and while the markets are pricing in “higher, for longer”, the reality appears to be pricing in an impending recession.

Frequent readers of my blog would know that I often start this section with commentary about the macro-environment (which is quite important since Nov 2021; check the price charts). That said, I think the next 6 to 9 months are quite important, both in terms of how we should position our portfolio, and how we should deploy what spare (extra) capital that we might have into the markets.

We’ve seen the overall market sort of bottom late last year, pivoting into a face-melting rally for the start of 2023, before ranging in no-mans land at present. It really could go anywhere, but consensus appear to favor a downside move rather than an upside move. It’s hard to imagine markets (especially growth stocks) move higher from here, through both valuation, and earnings lens.

Edit: Markets indeed moved higher, following Nvidia’s monster guidance (more on that below).

We’ve seen from many companies (including hyperscalers) comment on the slowdown of discretionary, with mid-caps also experiencing elongated sales cycles (see Cloudflare). I cannot imagine them surprising on analysts’ expectations, and rallying post-earnings (though some do, but the overall sentiment still appears weak).

Thus, I am aligned with market consensus that we’ll see a lower market sometime from now till the end of 2023. Reality is, even if market goes lower in 2024, you’re probably nearer to rate cuts, and any signal by the Fed will again, lift all boats in a rising tide.

I do like the idea of buying the next 6 months and selling (or taking profits) after 2 years.

What do you think?

It’s a real struggle finding the money to do so though, with IRL big-ticket items coming up (more in my Life section). Anyways, my transactions for the month of May:

Buys: DDOG, CRWD (2x), SNOW Sells: Nil.

My earnings commentary below for Datadog, Cloudflare, Sea Limited, and Snowflake.

Datadog

While the company experienced a slowdown in spending, its churn remained best-in-class, in the mid-to-high 90s. Management also shared that their DBNER will drop below 130% in the next quarter (after being above for 23 quarters straight), which is a sign of the external environment for customers being a little more challenging. Despite all that, Datadog still managed to raise guidance, which is quite impressive.

They released a couple more products into GA, and cited numerous customer wins (as they usually do), with added commentary during the Q&A that they’re seeing resumption of cloud spending trends after the slowdown seen in the past 2-3 quarters. Company performed well and could very well be the first ‘dog’ out of the pack when the environment gets better. Woof.

Cloudflare

Relative to the Big Dog (Datadog), I had always found it less appealing to hold, because Cloudflare’s growth profile is weaker (growing same speed, at about 60% of revenue). Simply put, Cloudflare isn’t as big of a “dog” as I would had liked it. It needs to improve in terms of their GTM, and it needs to do so fast.

While they’re technologically superior (my own opinion) to their competitors, they should be doing everything they can to win over customers, even if it means a temporary compression on margins. In their investor day, they shared that about 20% of current ARR in FY2022 is contributed by Act 2 products (Security). The majority came from their CDN business, which is frankly quite disappointing to me, given how strongly their CEO speaks about the Security product line. That said, it has improved (doubled) since 2021, and my expectations are for the % share to continue increasing.

Sea Limited

The quarter of turnaround continued, with 2 constants: 1) Garena (Free Fire) bleeding revenue like crazy (950m > 540m QoQ), and 2) Adjusted EBITDA staying resilient (and growing a little) despite 1. I appreciate the fact that they made headways into enhancing their logistical capabilities, as well as continuing on the profit momentum for the Shopee market for Asia. Brazil is on a ‘choose-to-breakeven’ basis, and it does feel (even ever so slightly) that the resilience and growth of Shopee can more or less offset the bleeding cash cow. Sea Money was also steadily increasing, but even the sequential growth appears to stall, with a +48, +53, and + 33m in revenue for the prior 3 QoQs. Will it sustain - I’m not sure, but the turnaround story appears in full force, and clear skies are upon us, when the worst of the consumer weakness is beyond us.

Still long the name, and based on the chart, it appears to be forming a base, and possibly preparing for a uptrend (?). We’ll see over the next few quarters.

Snowflake

The company saw a -15% day after its earnings, which seemed good on the surface, but foretold a second quarter of 2023 with practically no growth in the consumption-based business. This was because the company extrapolated the consumption trends they saw since March to April, which saw little to no growth. So the guidance is pretty conservative, but there would be further room to fall, if consumption trends fall even further (which would be pretty bad).

That said, the long-term business model, and investing thesis of the company remains intact - and should rise in tandem with the value of data. Still a decent quarter nonetheless, but will have to keep an eye for any prolonged deterioration in the consumption trends (only to buy more).

Nvidia

I don’t own the company any longer, but would like to share my thoughts on it, given that it guided for ~11B, which is 4 billion higher than what analysts were expecting (~7b). This is an insane markup, and its no wonder the now mega-cap gained 200B in market capitalisation overnight, which was essentially a Alibaba or a Salesforce.

I’ve not seen such a ridiculous guidance from a large-cap ever; recall that I (stupidly) sold my final tranche around ~$280, as I thought the valuation was too high. I made some right rotations, though, rotating the profits into Crowdstrike and Datadog.

It hit a high of $419 (not $420 but I’ll take it), and is now at $378. What goes up (exponentially) must come down. Longer-term thesis is very much intact though, and a correction is very healthy. That said, I may not have the spare capital to restart the position. Well then, love Jensen Huang though, he’s pretty damn cool haha.

DCA investments

Endowus

I’ve made the decision to increase my contributions for Endowus from $300 to $450. My only holding on that account is BlackRock iShares SP500 fund, tracking the US index. Aligned with my conviction that the next 6 months represent the best times to DCA into the markets, I needed to increase my contributions to match my confidence.

As a result, I had to stop the monthly contributions going into URA (Uranium ETF) so that I’ve more money to deploy. URA as a position is already quite large (in dollar value), so there’s no need to overweight my allocation into the commodities sector (which experiences a different kind of bull/bear cycle than SP500).

While it’s really a slow drip, the time horizon for this account is definitely over 20 years, which is why I shouldn’t over-leverage myself by putting in more money that I cannot afford (important!). Over the next 3-5 years, I think the early fruits of my labor can be seen, and I’m able to gradually increase my contributions, alongside my salary.

URA

As mentioned above, I stopped my DCA strategy for the Uranium ETF, and will let it ride for the next 3-5 years. The fate of this portfolio now rests on how the world views the prospect (and benefits) of nuclear energy. I’m borderline hopeful that the world will view it as the ultra-clean energy source that is should be, and production of nuclear reactors continue, alongside innovation in smaller-scale miniature reactors that can be deployed anytime, anywhere.

Crypto

I couldn’t find the tweet now, but around 10-15 May a well-known figure on CT (known as Ansem) talked about how H2 2023 would be the best time to buy , after which one can sell 2 years later (for unknown profits).

Based on my amateurish understanding of the markets and the macroeconomic forces at play, I’d have to somewhat agree. We are already seeing the end of rate hikes, and the difference between what the Fed is signaling and what the market is pricing in, is when these rate cuts happen. Fed is saying that it’ll be higher for longer, whereas the market is trying to call the bluff.

In any case, calling the bluff takes multiple months to play out, since every decision made by the Fed is made via data (i.e. CPI). During that time, markets could very well price in recession, because discretionary spending has been impacted by high rates, and we know that economy growth relies on stable consumer spending.

It could very well be 9 or even 12 months to the start of rate cuts, but markets (for individual stocks) by and large bottom before that, since market prices are generally forward looking. In this thought experiment, we are essentially trying to front-fun the investors that will enter the market after the Fed’s all clear. I would prefer to enter the market earlier, even if it means going under-water for a little bit.

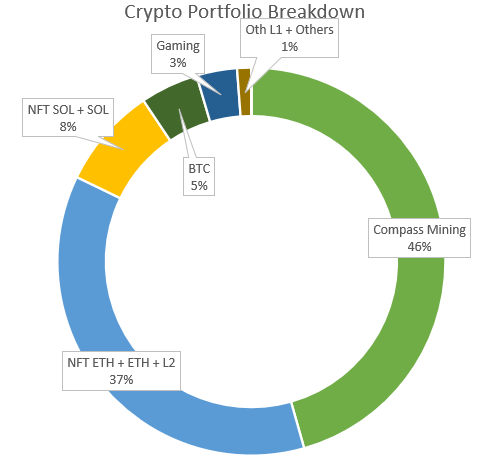

This is similar to my thoughts above, and is what I’ll try and do for the remainder of 2023. My main 3 holdings would still be BTC, ETH, SOL (not in order of size).

My BTC DCA is taken care of by my Bitcoin miners, while my ETH positions are influenced by my NFTs (e.g. Kanpai Pandas, Pudgy Penguins). For Solana (my bias lol), I am putting IRL money to physically purchase Solana on a monthly basis. I also have 2 NFTs there as well which can hopefully appreciate long-term.

I had considered buying another NFT in Mad Lads, but felt that the price risk was just too great, for a collection that purported not to possess any utility. I’m fine with that, since the key to price appreciation is demand > supply - utility matter less, unless there’s somehow a farming component for these NFTs, farming tokens that one can sell in the DeFi markets. I’m still undecided on this decision, and depending on the price fluctuations, I may yet dip my toes into the NFT market once again.

If there aren’t any good opportunities, I’ll simply store it as my long-term Solana position. My holdings are below:

Pudgy Penguins

Something interesting happened for my NFT project on Ethereum - Pudgy Penguins. To my surprise, the NFT project had released plushies of the Penguins on Amazon, named Pudgy Toys, which are the first mass-market product licensed directly (and owned ) by the Pudgy community. Each toy is linked to a digital experience (on Matic), which comes with a blockchain wallet, and a unique trait box from season 1 of Pudgy World, which you could use to customize your digital penguin on Pudgy World (e.g. Habbo hotel vibes). The full thread introducing this can be found here.

It’s been awhile since I’ve seen a push towards Web2 from the crypto-sphere, and with toys, it strikes a decent chord with normies (see Hello Kitty), and greatly lowers the barriers of entry for non-crypto folks to enter the crypto world. The sale of these plushies also creates a source of income for the project, which eliminates the need to rely on secondary trading of the Penguins itself, and also generates an extended runway to survive past an extended bear market.

When the next bull market comes knocking, they’ll have plenty of cash to deploy into initiatives that can really make Pudgies known worldwide.

Mining chart

May was a much better month for my miners than April, and that was because of the NFT renaissance that took place on the Bitcoin blockchain. Some called it inscriptions, other referred to it as ordinals, but essentially there was a way to mint “NFTs” on Bitcoin and all that led to much higher transaction fees as pleb after pleb tried to front-run the transactions of others.

The block rewards are fixed, of course, but the transaction fees are paid to miners, when they mine a particular block. I’ve seen upwards of 10% of my daily revenue (0.0002 BTC) as a bonus, compared to just 0.00004 BTC just 1-2 months ago.

I don’t have any skin in the BTC NFT game, but I for one am happy to be mining during this golden age of Bitcoin NFTs. That said, it’s still a pain to have to inject IRL capital to pay for the facility fees that are currently hosting my miners, but it is what it is. My profit chart below:

Life

This month is a little lighter both in social events, as well as workload. It’s thankfully pretty chill for me, though not for my body, which suffered under the ongoing heat wave. Every second out of the shower is an opportunity for my body to start sweating, and my work-from-home station isn’t the comfiest of places (thankful still for 3 days of work-from-office).

I’m also chugging along my Data Engineering Professional Certificate on Coursera, which I’m struggling to complete due to the weather (excuses, I know). After a long day at work, its hard to continue the momentum at night when the it’s not even cool (so much so that I have to shower before I sleep, again). Not cool.

Anyway, I hope to complete this professional certification in a few months, after which I’ll start working on some hobbyist projects to apply my learnings, especially in areas and technologies that companies are looking out for, such as Spark, Airflow, Databricks, and even Snowflake (and SnowPark). All the best to me.

This month was also when my wife and I bought our Japan tickets. It was very exciting indeed, planning from scratch everything about Japan that we want to go. It’s our first time there as well, so I’m sure we’ll enjoy every second of it. Planning to head to Tokyo / Osaka / Kyoto / Nara for a ~10 day trip. Here’s to hoping I have enough time (& money) to thoroughly soak in the sights and experiences that Japan has to offer.

Conclusion

What started out as an investing journal has fortunately evolved into so much more, and I hope you continue with me throughout this investing journey, even as I invest in my future family (kids to come perhaps in the next few years).

Thank you for reading thus far, and I’ll see you next month :)

Cheers,

Joey