Portfolio review - May 2022 (Equities)

Welcome to Goblin Town - Part Deux

Regrettably, this newsletter about my portfolio has gotten a little long. Hence I’ll split it into 2 parts. Here is a handy table of contents (which might change from time to time) that you can navigate around to read the parts that interest you.

Portfolio performance

Equity portfolio:

Breakdown

Performance

Movements

Crypto portfolio performance

Net worth changes

Commentary - Equities

Broad commentary

My portfolio movements

Life

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

Cost allocation: Based on my set target in USD. > 100% means over-allocated…

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

Equity Portfolio Performance

I’ve recently switched brokerages, and so the cumulative returns will be a little wonky. It is clear as day though, that my portfolio was decimated in May (despite the end-of-month rally). Down, but not out. 💪🏻

Time-weighted returns (IRR) & CAGR - Past 12 months (right), New brokerage (top left), and cumulative (bottom left)

CAGR* Performance

Note: CAGR for my portfolio is calculated as [(market value of portfolio including cash) as a % of cost - 1]. CAGR for NASDAQ & SP500 is calculated by retrieving the month’s performance (e.g., 5%), then extrapolating it over previous month’s market value + $ injections in the current month. This is also known as money-weighted returns.

It’s a good measure for non-investment savvy folks who wants to know how much money they take out vs what they put in; Value over cost. My chart is an attempt to simulate this by using MoM returns of classic benchmarks to compound my cumulative additions into stock markets. I’m doing this bc investment calculators for NASDAQ & SP500 isn’t as accurate I would like them to be.

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing below.😊

Equity Portfolio Changes

Added: DDOG, U, TWLO, SNOW, ROKU

Started: TSLA

Trimmed: nil

Sold: nil

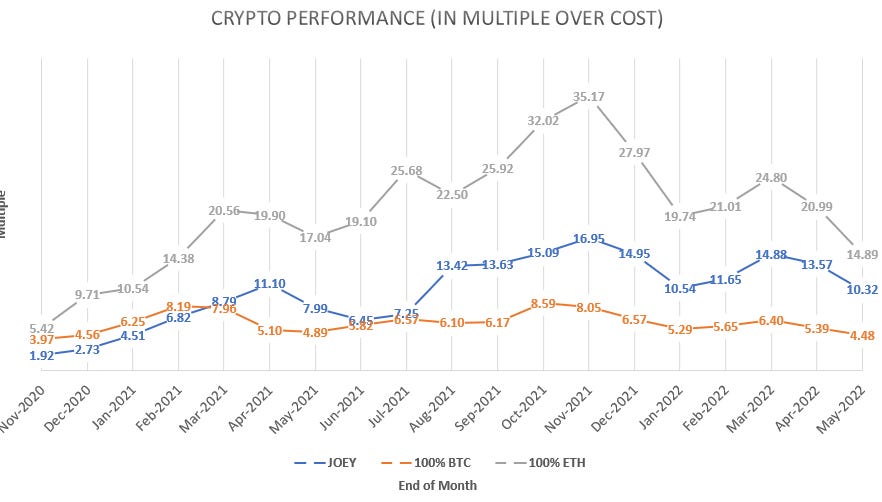

Crypto Portfolio Performance*

* Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 10.32x my cost

Lifetime result:

- Achieved 2.30x of BTC performance (10.32/4.48)

- Achieved 0.69x of ETH performance (14.89/10.32)

Goal is to try and outperform BTC and ETH from here on out. 👍🏻

% of Net Worth (direction change from previous month) in:

Stocks: 15.1% (🔼🔼)

Crypto: 75.2% (🔽🔽)

Net worth excludes fixed assets (e.g. house).

Equities

Equities move due to buying and selling. Majority of the volume is transacted by algorithms that trade at the millisecond or even microsecond on sentiment, text or any other information that can be parsed by AI. This further brings to bear (ha) the importance of not getting the time right, but instead getting the long-term direction right. Most of us don’t want to spend more time than is necessary on the stock market, so we must be able to abstract ourselves and reflect on the entire market as a repeatable cycle of human nature.

An anecdote: I was at a gathering with some friends and new acquaintances. The inevitable stock crash came up; everybody that had US exposure resigned to fate that their portfolio value is now swimming in the depths of the Mariana trench (aka underwater).

It felt surreal, because they too struggle with the stock market, despite their high-flying careers. Buying company X that turned out to be a dud (e.g. $PLTR, $U, list goes on and on), and then consciously switching off until the stock market stages some form of rally. Attaching emotions or being affected by stock prices was something I fell prey to, during the crypto crash of 2017-18, as well as my early casual investing days (2012-2016).

It appears that there’s a general consensus in wanting to suffer together. This is something that Peter Lynch highlighted in his famous lecture (shared it in my last article). Paraphrasing, he said that it wouldn’t look good if he (the fund manager) was out golfing when the fund crashed alongside the market, even if there was nothing that he can do. The sharing of pain seemed to be a common theme throughout life.

This leads to a self-reinforcing loop where everybody accepts the current consensus thinking, which can be hard to make contrarian moves (e.g. buying in fear, selling in greed). How then, can average retail investors get out of this loop?

My stance (as regular readers would know) is that retail investors (perhaps even me) generally don’t understand how the stock markets work. I’m certainly no expert, and whatever I’ve learnt, I’ve shared with you for a few months now via this Substack already.

Clearly, we are in a different financial environment vs 2010-2020. Understanding how the monetary cycle works (tightening, easing) and its effect on the stock market is super, super important. If you’re a stock-picker, you must of course understand everything about the companies you own.

People always like to quote gurus who got in companies early, but nobody mentions the gut-wrenching 50-60-70-80 or sometimes 90% drawdown for their all time high. Survivorship bias naturally tells us that for those that made life changing money by buying $AMZN from when they’re categorized as small caps, there are those that lost it all buying $ABCD that had a 90% drawdown but never made a new ATH again. Excluding lucky investors that forgot about their stock holdings, truly successful investors check and verify their thesis along the way. It can be hard to do so if you’re investing based on 2nd hand sources and not supplemented by your own understanding of how the company works and how it fits into the broader industry.

For me, I routinely review the earnings results and call for my portfolio companies, then summarize the findings into a 1-pager quarterly review of their performance, financials, product lines, and outlook. You can view my thoughts on my portfolio companies, as well as my highest / lowest buys here.

If you’re just trying to DCA into market indices such as $VOO (S&P 500) or even the ARK Invest ETFs, here are some words of wisdom (in my own words) that stood the test of time (have been bombarding you over the past few months):

Share prices go down, and they go up. They go up most of the time, but sometimes they go down for brief periods, but during that period, it can go down further than anybody expects. Periods are often measured in months/years.

Buy when there is fear, and sell when there is greed.

Negative events feel 2-3x as bad as positive events. You feel more pain during the former than you feel joy during the latter.

Sounds simple eh?

The common fallacy of “just waiting it to go back to breakeven” is as treacherous as they come. How can you make money if you don’t buy it low? Waiting to switch on again only after a substantial rally has taken place in your stock seems quite ludicrous to me, especially since you can never time the market (if you could have, you would’ve sold everything in Nov 2021). Where is the point of maximum financial opportunity?

Since shares are ownership in a busines (usually having net positive assets), it’s intuitive I guess that the value/worth of a certain asset (share) is lower if it is priced lower. Realistically speaking, if we take that to be the case, we should only buy $SE above $300 and $TSLA above $1100, and sell them 50% off of their ATHs.

Right…?

That is why investing is so hard. I too am struggling in terms of my portfolio performance, but my intuition / knowledge tells me that:

Share prices won’t go to 0 (it really can’t, even at point of bankruptcy)

If share prices crash another 50%, it might cause stresses in the financial system which will force Fed’s hand to ease monetary conditions again. What do you think happened when monetary conditions were eased (circa Mar 2020)?

The best times to buy shares are usually when there is panic.

The timing will be even better if the entire market is panicking (& not just for your companies)

Stock market moves slower than what mainstream media reports. Rallies happen over the course of 1-3 years, and likewise recession happens over 6 months to maybe 1 or 1.5 years, every 7-10 years.

In no way is this financial advice, but generally speaking, riches are made by buying low and selling high. Sounds crazy right?

Over the short-term, price does not equal fundamentals (but way more correlated with sentiment). How can companies that consistently beat analyst estimates continue to go down? Another piece of the puzzle is multiple compression, but I doubt anybody here wants to learn it through the Substack written by a retail pleb who has grossly underperformed the market. If interested, read the tweets of this guy.

Have also watched a great podcast by Simon Erickson (founder of 7investing) and Puru Saxena, a long-time infamous FinTwit Furu (most famously ridiculed for selling out his growth stocks at 2/3/4x gains when others were expecting 10x).

These 2 folks are also great at their craft (happens to be growth investing as well). TL;DR of the podcast above: Need to find the FAANG of the 2020s (i.e. next 10 years). Fed won’t impose tightening monetary conditions forever, and once inflation is squashed, what happens to general market liquidity? Does it get tighter or looser?

What about the stock market?

Anyway, I’m still young (28) so I have time and money to embark on this journey of risk for future potential reward.

Equity Portfolio changes

I managed to transfer my stocks from Saxo into Interactive Brokers. The main motivation was to save on fees, as well as to track my portfolio performance better. It took around 3 business days, with fortunately no hiccups. I also had to incur about $230 SGD in transfer fees, for about 9 stocks, so not really sure how the costs were calculated.

Anyway, that’s hopefully the start of lesser fees, but as if that’s gonna help my portfolio. Enough rambling, will discuss my adds below.

Unity

Dumb move before the dump. Bought the stock pre-earnings (4th May, which was 6 days before it’s earnings after hours). I don’t know what it is about my flaws that I repeatedly buy stocks before the market can react to their earnings. My thoughts then about the purchase (have written brief comments to justify each buy/sell I do).

Dip below IPO price, bought some to allocate cash and low price for long-term stock with secular trend. [Bought $64.45]

Sure enough, market did had something to say about Unity’s earnings, which suffered a one-time revenue impairment due to one of their ML-focused products that ingested bad data. Stock price bottomed around $29, and is now $40 (20May2022). Good company, strong market position (duopoly with Epic Games). Wrong timing. 💁🏻♂️

Datadog, Twilio, Tesla, Snowflake

These adds weren’t made pre-earnings, but generally was done so during market drawdowns. Market caps & revenues discussed all from Jamin’s Clouded Judgement (27May2022).

Twilio has become cheap, but still growing reliably at 30% at a Last 12 Months (LTM) revenue of about 18.5b (market cap) vs 3.1b (revenue). That’s about 6x. Datadog, whilst at a lower LTM rev point, is growing a lot faster, even surprising estimates time and time again. Market cap 30b vs 1.1b revenue. That’s quite expensive, so will slowly add, hopefully in the 70s and 80s. I rate Datadog higher than Twilio, given that Datadog has already been GAAP cash flow positive for the past 8 quarters, DBNER > 130% for consecutive 19 quarters (!!) and just got positive operating margins.

Tesla is a position I restarted after having sold both my stock near $1100. I felt $710 (which i reopened at) was quite a steal, but with the price now $785 (after hitting $658), let’s see the confirmation of direction before thinking about adding more. Market cap about $785b vs LTM revenue of 62.2b. Ok slightly above 12x, that’s ok. Tbh I think I’m doing this multiple calculation wrong, and I don’t really care, since I’m not going to need the money for 3-5 years, and Tesla will likely be EV leader in next 5-10 years.

Snowflake was an add immediately post-earnings where it dropped -13% the next day (I bought $116), but recovered up till -5%, just in time for rallying into the end of month. Ok all that said and done, let’s look at my wish list from April’s article. Prices as of 31May2022.

[now $187, low $155] NVDA:

$175/ $150 $140[now $758, low $623] TSLA:

$900 (200DMA) / $750 (local low)$550[now $128, low $112] SNOW:

$155 / $140 (10-20% lower)$120 (IPO $)[now $160, low $130] CRWD:

$175 / $160 (local low)$120[now $83, low $55] SE:

$75 / $65 (my first buys in Q2 2020)$50[now $95, low $76] ROKU:

$85 / $75(near Covid lows @ $56) $65[now $56, low $50] NET:

$75 / $65$45[now $34, low $28] TDOC*:

$50 (Covid low) / $45[now $105, low $88] TWLO:

$110 / $100$90[now $95, low $82] DDOG:

$100 / $90$80[now $4, low $29] U:

$65 (~IPO price) / $55 $30

*Exited position in TDOC.

Sliced through my wish list like butter. Oh, we’re definitely in goblin town now. Updating my new wish list (in bold italics so let’s hope that I have the balls (and the cash) to actually act on it).

Life

These few months have been quite the change for me. In March I officially joined the ranks of a future houseowner; April I proposed to the love of my life; This month I changed jobs and am now working in a data-focused job more related to data.

About half a month into this job, I think there’s a general level of self-accountability in the team (which is small for the amount of workstreams we’re handling). Everybody seems on-point & more pro-active with their deliverables and portfolio which makes it an environment with a tighter pace. This is quite different from my previous job, where timelines / deliverables are measured in yearly cycles. Of course, I chose to be here, and I fully accept the changes and disruptions that this job will bring.

It’s a small team, and we handle surprisingly operational stuffs as well, which requires a deep knowledge in the realm of procurement, finance, and vendor management. Guess we all gotta start learning somewhere, huh? My team are also considered late-risers (or maybe I’m just the early bird), coming to work from 9-930 am onwards. As a person who prefers to work early (and end early), this was quite the disruption. Furthermore, I needed about an hour to travel to and fro work, which means I’d usually reach home close to 7PM. Given that I exercise quite regularly, this required changes in my exercise routine.

Instead of evening exercises, I now exercise 3x in the mornings where I have to go to office, and 1x in the evening when I work from home. I also noticed a better digestion process after the morning exercise & my regular black coffee, so I guess this disruption is for the better.

On the job itself, I am glad that the team & our portfolio has wide exposure in general business / operational matters, and that we interact quite often with senior management as well as vendors. This exposure is essential for career opportunities because it arms you with the management-type skills rather than the specialist-type skills. One things for sure; learning curve will be steep & I’d have to keep up.

That said, it’s still rather early in my career to think about this, but I do know that the future months will be tough and would involve ad-hoc work / data request being pushed onto our team (during ungodly hours)! For this, I will prepare for the worst and hope for the worst so that I don’t bring my hopes up (low expectations = happy life). With pain usually comes growth, and I am confident this will be the case too.

Conclusion

Thank you for reading thus far; I hope you learn something from the things I write (be it about the markets or about me). Feel free to drop any comments or suggestions on how I should make my articles better! I fully acknowledge that the lengthiness of this article is quite a big problem, and making things concise will be something I hope to master in months to come.

Talk to you next month.

Cheers,

Joey