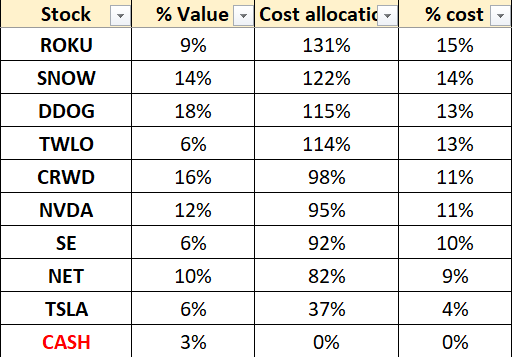

Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

Cost allocation: Based on my set target in USD. > 100% means over-allocated…

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

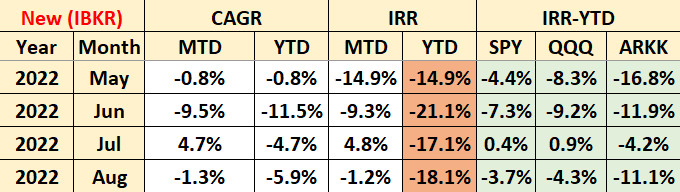

Equity Portfolio Performance

I’ve recently switched brokerages, and so the cumulative returns will be a little wonky.

Time-weighted returns (IRR) & CAGR (top), cumulative (bottom) - Since new brokerage. Historical returns (middle)

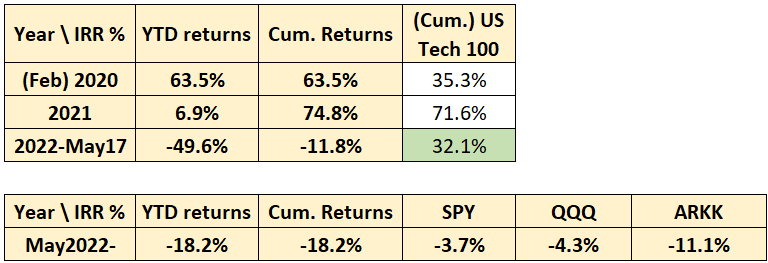

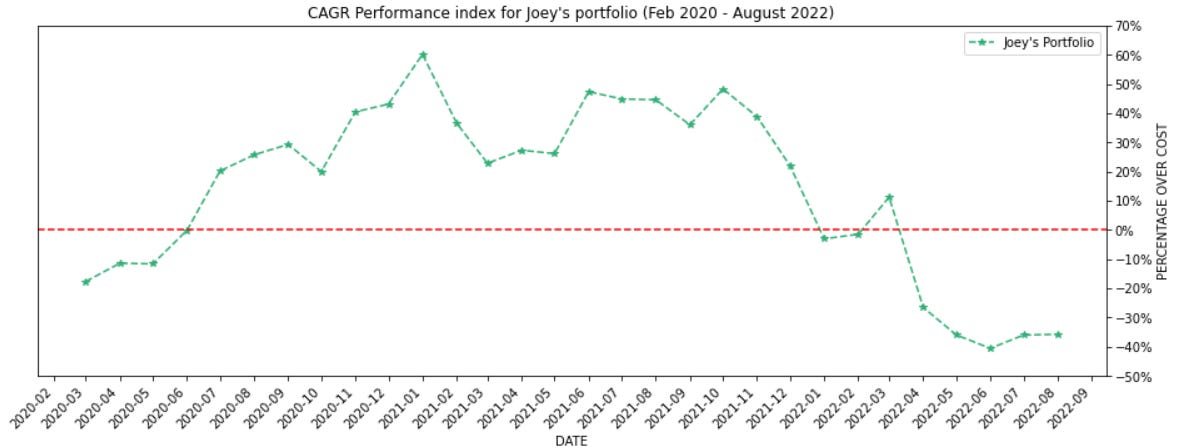

CAGR* Performance

Note: CAGR for my portfolio is calculated as [(market value of portfolio including cash) as a % of cost - 1]. The CAGR returns are compared in the above table instead.

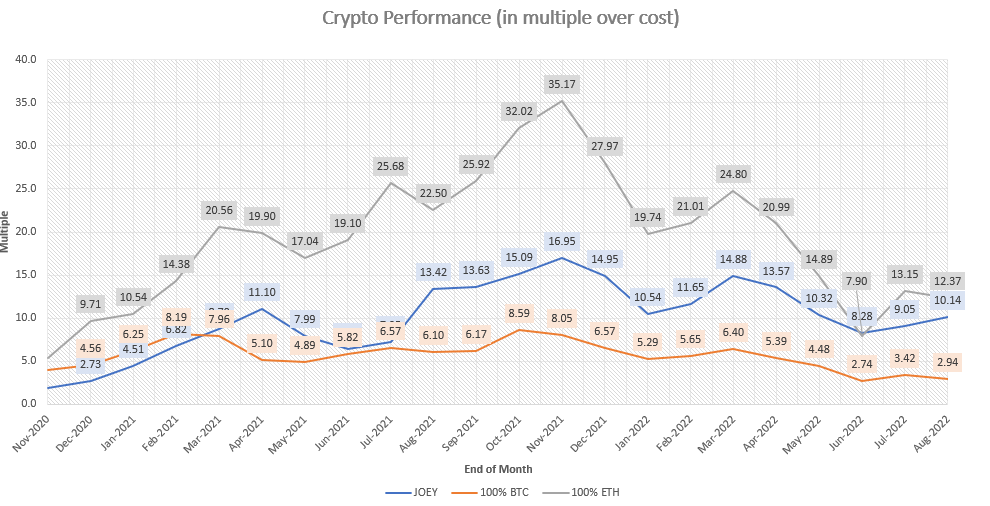

Crypto Portfolio Performance

* Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 10.14 my cost

Lifetime result:

- Achieved 3.45x of BTC performance (10.14/2.94)

- Achieved 0.82x of ETH performance (10.14/12.37)

Goal is to try and outperform BTC and ETH from here on out. 👍🏻

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing below.

Equities Portfolio Commentary

=== Portfolio Changes ===

Added: DDOG 0.00%↑ , TWLO 0.00%↑, NVDA 0.00%↑, TSLA 0.00%↑, NET 0.00%↑, CRWD 0.00%↑ (x2)

=======================

Is June/July the bottom for stocks?

Pretty bold statement if you ask me, but I’m in the yes party (muh heavy bags).

Inflation was the talk of the town since Apr/May when headline numbers started screaming so high that the White House had to announce in advance that “inflation numbers are going to be very high” just to allay citizen’s concern of sky-high prices.

Expectations got exceeded, and matching expectations meant a red day, which continued well until July when we already hiked 2x of 0.75% and the Fed mentioned that we are close to the neutral rate (aka where rates should be to ensure they can achieve their mandates, or around ~2%). We hadn’t seen much of the QT from the Fed’s balance sheet as it’s currently in run-off only mode (aka no active selling). Commodity prices had their boom & subsequent bust (Crude Oil came back down from ludicrous levels of $122 to about $88 (22 aug), for about a 25% price decrease).

Happiness at the pumps! Inflation began showing signs of softening, and everybody is hopeful that this inflation that stuck with us for nearly 6 months will be transitory, as originally remarked by the Fed.

Markets go up when there’s no willing seller.

After months of forced selling since November 2021 into May 2022, who’s there to sell to anymore? The last folks to sell are usually traders who are greedy and think that the floor’s gonna come off leading to another round of price crashes just like the one we had in November 2021. These are the folks that will provide us with the jet fuel needed (aka short squeeze) to burst through bear territory and into the bull zone.

Much of this is being realised in recent weeks. It is a truly refreshing view to see your portfolio in the green again. Will the beaten bear come back and bite us? Unlikely, but what if it really does? What will you do? What are your next steps?

Portfolio changes

I made a pretty bad decision in selling U 0.00%↑ at the end of last month (26Jul2022) at an abysmal $33.70. Unity then promptly made an unironic climb to $50+ where AppLovin coincidentally submit a non-binding proposal to merge with Unity (valuing the share at about $58.85), on the condition (among others) that they terminate the Ironsource merger. Price went to $58 in 11Aug2022, to now $42.72 on 26Aug2022.

I could have sold at $58, my lord.

Hands down one of the worst decisions I’ve made in 2022.

On the bright side though, I was able to deploy what I had left from selling (not a lot) into better opportunities, such as DDOG 0.00%↑ , TWLO 0.00%↑ , NVDA 0.00%↑ , TSLA 0.00%↑, NET 0.00%↑ and CRWD 0.00%↑.

For Nvidia ($175), I added some as part of my quarterly buy; they pre-released their earnings which showed a big slowdown in Gaming revenue (putting Data Center revenue squarely as the top contributor to Nvidia’s topline). I saw that as an opportunity to buy shares of a company in a mega tailwind - AI. Gaming weakness can be attributed by macro and cyclical factors but the need for stronger compute and more powerful chips to accelerate AI will wow even the most conservative of us.

For Tesla, it was a small half a share ($862 → $287 post split). For all the hate it receives from $TSLAQ crowd, the fact remains: they are outselling EVs by quite a big margin, and will likely to continue capturing market share (with CyberTruck starting production by mid-2023). Elon Musk has repeatedly shared on earnings call that they are not demand constrained (the 6-month long waiting list says something). Earth is shifting towards EVs; Tesla is also at the right place at the right time. For all of Elon’s antics, I think he’s on the right track with Tesla. My commentary here.

For Datadog, I bought 5 shares ($95) before earnings and then 5 more after earnings ($105). I bought them before because I felt a little FOMO and I was quite confident that Datadog will exceed analyst expectations (& possibly raise guidance). Whilst they didn’t, the broader market lifted all boats, and I was caught on the backfoot; hence why I added 5 more the day after earnings. Of course, over the next 2 quarters, it is unlikely that they can continue to keep growing at the same % YoY (due to tough comps) which means a higher probability of missing estimates that can result in an earnings dump. Long-term thesis remains intact, of course. My commentary here.

I’ve also bought a little Cloudflare despite its valuation ($76), and it was due solely to their resilient topline growth (50% YoY for multiple quarters already). Not only that, they raised their guidance when many of the SaaS peers held or lowered it. The ability to get businesses even when times are tough and purse strings are tight are very good indicators of exceptional management. I believe Cloudflare has that. Coupled with their long-term vision of Acts 3 (Security/Zero-trust) and 4 (Workers - Edge computing), I am quite comfortable with the business trajectory and will hopefully be a long-term shareholder in this secular compounder. My commentary here.

Lastly, for Twilio, it is now a second or even third tier company, together with U 0.00%↑ (which I’ve sold), ROKU 0.00%↑ and SE 0.00%↑, both of which are very vulnerable to slowdowns in discretionary spending. I still believe that Twilio’s CDP offerings (e.g. Segment, Engage) will lead them out of this bear market that they’ve landed themselves in. With the current narrative being that that the messaging business is too strong (thus lower gross margins), I do wonder if the business is any good at upselling existing customers for the CDP (should be in GA by second half of this year). Still, there are tailwinds given the continued focus on privacy (e.g. IDFA, deprecation of cookies). My commentary here.

Of my stocks, CRWD 0.00%↑ is the odd one out, the lowest in terms of my absolute $ invested into it. It saw an impressive bear market rally ($130-$204, +57%) which I hoped will break down but didn't (now $189, on 31Aug2022). Given the quality of this company (my highest conviction bet right now), I think it should be overweight, and I'll spend most of 2022 making it happen. My commentary here. Edit: Added a little as I wrote this on 22Aug2022, at $186. Let's see if it gives lower. Edit 2: I FOMO-ed yet again post earning, buying a little more at $197 (ended day at $180 😭) on 31st Aug 2022.

Crypto Portfolio Commentary

=== Portfolio Changes ===

Added: ETH, SOL

=======================

Everybody and their mother seems bullish, particularly around Vitalik coin and the impending ETH merge (which does nothing but transition ETH into a Proof-of-Stake chain). To be honest, I feel the same way as well.

When LUNA rocked the world of crypto L1 chains (by being one of the largest L1 chain (albeit backed by algo-stable $UST) to fail spectacularly), we thought the world was going to end, and for a moment it did as BTC sliced through $26k, tumbling towards 22-23k. Like I mentioned during the June writeup (in which I also included some first-half-of-2022 lessons), June basically said hold my beer.

3AC which for the entire bull market from 2020 till then was basically idolized with them preaching the super-cycle (hypothesizing that BTC will hit $88,888, and epochal figure). Fanboys quickly coined the zhupercycle after its founder, Su Zhu. The rest, is of course, history as 3AC’s shocking insolvency (due to them being too invested in $LUNA) took the crypto world by storm, this time sending BTC to the depths of the previous cycle ATH ($18k BTC, $888 ETH).

The above 2 paragraphs are what crypto-native OGs call contagion; the event itself carry with it secondary effects, the fear of which compelled everybody to sell, resulting in forced liquidations of some stETH / ETH being used as loan collaterals. In hindsight, when contagion hits (or when the thought of buying makes you sick to the stomach), it’s likely time to buy.

Fast forward to August and these events are but a tiny speck in the rear view mirror. The market looks forward and with 2 of the biggest tail risk events being realised in just a short span of two months, the market was right to assume that it’ll be blue skies thereafter. Of course, with the inflation readings getting better and better, risk markets worry less about the iron hand of the Federal Reserve and more about future catalyst. Cue bullish articles on crypto, Web3, and most importantly, ETH. Arthur Hayes has been writing non-stop bullish articles about ETH and honestly it probably influenced me one way or another.

Would you really want to fade a person with such size? Absolutely can’t be me.

Let’s do a stock take of the current market situation:

Macro slightly forgiving (CPI, PPI & inflation metrics starting to roll over)

Crypto survived 2 tail-risk events (LUNA, 3AC)

After 6-7-8 months of selling (from Nov 2021), bottom seems to be in?

The last point is subjective, but it’s safe to say (bear market rally or not) markets continue to trend up (that is, until they don’t). Therefore as long-term investors (or as someone just trying to make it via crypto whilst practicing sound risk management strategies), how can we position our portfolio?

I humbly submit to you my thoughts on my portfolio allocation and how I think about positioning for the next 1-2 years (at least until some form of euphoria). No guarantee that I’ll achieve a positive return over this time period though, so please apply some common sense and don’t follow blindly.

First pot of gold

Let’s begin this section by acknowledging that crypto is a ponzi, though it doesn’t exactly fit Investopedia’s definition. What we mean by ponzi is basically the underlying assumption that everything in crypto is worth $0. Ask any investor worth their weight who’s a boomer and they will tell you the exact same thing. Worst of all, it’s true!

Before we can understand how to better make money from this pursuit, we first need to understand what crypto really is. At its core, it is simply 1s and 0s. Without crypto, the world will simply function as it is. You cannot say the same for commodities like oil, and gold, the absence of which will decimate entire economies or industries. We say that these products have some form of intrinsic value. Do stocks have intrinsic value? Investors will proudly proclaim yes (i.e. Current value of shares are present value of future expected cash flows). Then again, what’s the present value of shares if the company will NEVER return profits (aka dividends) to shareholders?

It’s just something for you to ponder over; we shall not distract ourselves from the subject of crypto. Like a piece of art, removing crypto from the world does not affect the world in any way, shape or form. Thus, the value ascribed to each token is what the collective market deemed its value should be.

It’s as simple as that.

The rationale for adopting this line of thinking is quite straightforward - we need to separate the valuation of crypto markets with the participants of the crypto markets. Since we have already decided that crypto valuations are not supported by actual business fundamentals (e.g. future cash flows, which btw will immediately classify your token as a security) or real-world usage (e.g. oil, gold), the only reason why the crypto market capitalization is > $0 is because people agreed that it should be > $0.

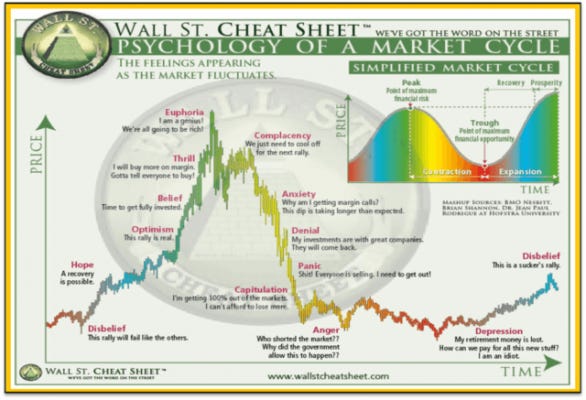

Here I’m isolating the human nature (& to a lesser extent, market cycles) as being the main factor for price swings in crypto tokens. It is from this point onwards that we can appreciate human psychology (& the wisdom/folly of the crowds) for what it truly is and harness it accordingly. The picture below is small sized on purpose; you only need to appreciate the line within.

This is exactly the reason why Bitcoin and Ether hit $65k (twice!) and $4.2k respectively, and traded $18k and $888 in the months after.

Where are we now?

I do believe we’re well past the bottom in terms of investor sentiment, and so our focus here should be to look for signs of euphoria in the upcoming cycle. Which token should we concentrate our positions in? My answer should be quite clear if you’ve reading from the start of the crypto section. (ETH!)

My preference for ETH over BTC was outlined a few months ago where I struggled to see how BTC can replace ETH (or even SOL) for Web3 industries (DeFi, NFTs). Make no mistake, BTC’s current (and only) value proposition is to be an un-censorable money that anybody in the world can use to transfer value. In its existing form, it will never be able to support DeFi and NFTs (critics will rightly point out that there’s development work to support such industries on BTC but it is likely too little, too late).

Given a potential future of crypto utopia (widespread crypto adoption), which coin will exhibit the strongest amount of value accrual? Is it 1) Digital Gold (only 1 use case), or 2) World Computer (n number of use case, aka metaverse(s) which is the hot new buzz word)? Bitcoin maxis always compare BTC to gold; hence, shouldn’t Bitcoin’s expected value be proportional to the total amount of risk assets in the markets today? If gold is 5% in the global portfolio of investments, then shouldn’t it be 5% also in your portfolio? Put another way, what is the value-add generated by Bitcoin or Ethereum, based on the use-cases it will unlock?

Tangentially, the value of a network is defined as the square of the number of users participating in it (Metcalfe’s law). Which of the two networks do you think will have the highest number of participants 2-5-10 years down the road?

I don’t know about you, but other than mining bitcoin (which is NOT the same as participating in the network) I have not used the Bitcoin network to ‘transfer value’, ever. Noah’s article on the economic misconceptions of the crypto world helps to also snuff out some of the myths you think you are investing in Bitcoin for.

Conclusion: Productive assets are always worth more than less-productive assets, in the same way that productive companies (claiming that they will solve n use cases, e.g. Apple) will always be valued higher than companies that claim to only solve 1 use case.

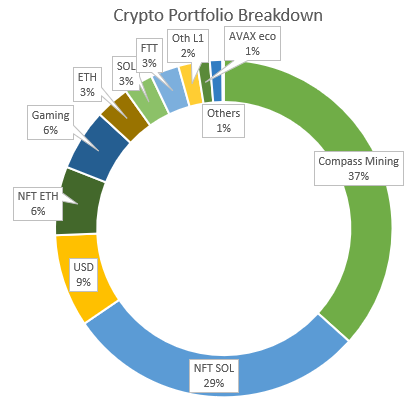

Portfolio allocation

How can we manage our portfolios then? Here are my portfolio holdings.

What do you want to own for the next cycle? There are only a few tokens that survived > 1 market cycle, endured the infamous crypto winter, and came out the other side still outperforming. If you want these tokens, you’re likely going to do well with a basket of BTC ETH and BNB. The first two choices are self explanatory; for BNB, it is backed by CZ (founder of Binance). There’s no way BNB will fade into irrelevancy since utility is directly manufactured into the coin (i.e. BNB is gas token for BSC and BEP networks, is used for fee rebates on Binance, and many more).

I’m an irrational believer in Sam-Bankman Fried and FTT, and I view the combined entity (FTX) as the western counterpart. Depending on which person you prefer, your portfolio would either have FTT and/or BNB (granted FTT is just an exchange token).

If you’ve been investing in crypto since 2021, you would have quite a few bags down 80-95% which aren’t getting back to breakeven anytime soon. It’s high time you mark these bags to 0 and move on. There’s no reason new inflows of capital will invest in old coins unless the underlying network/protocol undergoes substantial developments and changes such that the value proposition is amplified over time.

Even in crypto-land, we need to be cognizant of competition and the ‘next new shiny thing’ on the block. For a network like SOL, it seems like with regular advances in crypto innovation, new networks are being developed which just looks and feels faster, safer and better. Putting on my TradFi investment hat here, what is Solana’s moat and how has it been growing (or shrinking)? In my opinion, the user base in the NFT Solana community is as strong as it gets (far and away the 2nd best NFT network), and their DeFi space, while immature, is also a strong second (albeit facing competition from ETH L2s). As long as activity continues on Solana and is growing (especially in developer and active userbase), I see little to be worried about.

Naturally, investing in these tokens above will come with lesser risk and lesser reward (no 100x). Moving out further on the risk curve necessitates more time being spent to understand crypto and its meta (aka how to think about crypto).

If you only read about crypto only when there’s an industry wide event happening (LUNA blowup, 3AC, the Merge), then my (not financial) advice would just be to invest in the majors. While my interest in crypto remains, my IRL job has made it harder to study every new crypto protocol being developed and so the risk that I allow myself to take will be limited (and so will the rewards).

If you’re like me, there’s also another way to benefit from upside of the holdings in your portfolio, and that is via NFTs. NFTs are often priced in the native token (ETH, SOL) and it’s floor price (i.e. realistic price you can sell it at) fluctuates from time to time. Buying a NFT at 1ETH when ETH is $1000 vs buying 1ETH at the same price, NFTs will outperform if its floor price shoots to 2ETH, AND when ETH is $2000. Compared to just owning ETH, you’ve earned an additional $2k (or +1 ETH).

It goes without saying that the risk is high since you’ll never know whether the NFT you’re buying will be a BAYC (with a floor price of 81 ETH(!) or a scam or just worth 0). This is simply a leveraged bet on ETH (but no liquidation), with limited downside (albeit likely losing both in $ and ETH terms) and unlimited upside.

My ‘leveraged’ bets are on SOL and ETH and plan to ‘ride or die’ with these NFTs. I acquired 2 of each NFT because if you do decide to take profits, you’ll still participate in any remaining upside.

In summary, my portfolio allocation is focused on networks than individual tokens:

Bitcoin: Miners

Ethereum: Tokens + NFTs

Solana: Tokens + NFTs

Despite the decimation that the gaming industry saw, I still have a decent portion capital in liquid gaming tokens (and other tokens of class 2020/2021). If you’re a risk-seeking person like I am, then I think a trading bag (aka a portion of your portfolio) investing in the hype and buzz of crypto-Web3 is a good way to partake in any potential upside (and downside). The risk is naturally higher; your tokens are unlikely to moon and even if it did, you’ll find it hard to take profit (without first having experience the thrill of mooning then the pains of being dumped on).

Hence this trading bag must be a small amount, such that any rug-pulls or scam tokens won’t lead to risk of ruin. Let me emphasize here that:

You don’t need to get a 100x to be rich.

You just need a decent multiple every cycle, and the willpower to to maintain that ATH by aggressively taking profits. ETH to 10k (critics will laugh at you) but that will mean a good 5x on an all-ETH portfolio. Solana back to ATHs = ~6x current price. Do you still need that 100x?

A man can dream…

The way I manage my portfolio has simplified tremendously and I will likely keep it simple (KISS). What has changed is:

Adherence to risk management (aka being skewed towards majors)

Take profits (aka going to the moon but actually taking $ off the table)

Honestly, don’t worry about catching the next 100x. Even if you somehow pulled off 10k > 1 million, what will you do with that money? Studies have shown that lottery winners are quite likely to lose all their quickly gained fortune 1-2 years down the road, spending it on booze and just useless items.

The best kind of wealth is the kind that compounds slowly, but more surely :)

Up and to the right.

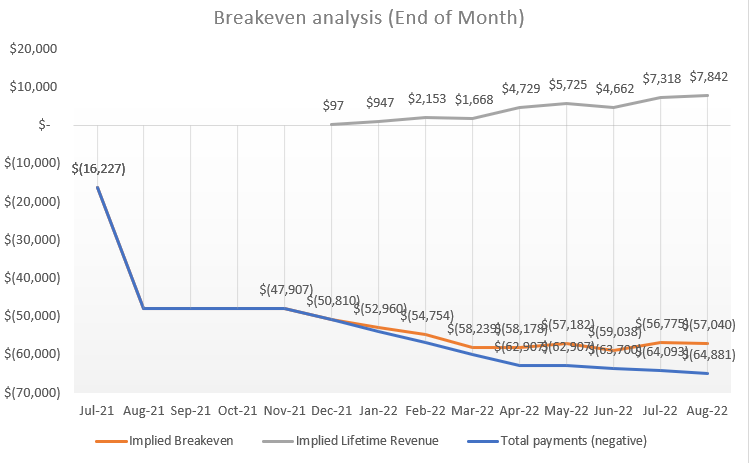

Compass mining

I made the choice to diversify my mining pool, from 6 miners on Slush Pool to 4/2 F2pool and Slush Pool because F2pool’s profit share is not influenced by luck. Granted, over a long period of time (e.g. 1 year), the impact of luck is negligible, it can be frustrating to see only 2-3 blocks mined for slush pool (which lowers your miner revenue) vs a constant payout based on your contributing hash rate regardless of blocks mined (e.g. F2pool).

I’ll be monitoring it for a month (up till Mid Sept) before deciding to just switch all miners into F2pool. Here’s my overhauled chart of my miner profits.

Because I’ve been rotating BTC out to ETH / USD, the profit metric isn’t quite right, since if ETH goes 2x, then technically my BTC profits in USD would also go at least >1x. To keep things simple I use the implied lifetime revenue (aka if I had not sold any BTC) as my ‘profit’.

Life

During the start of August I found myself at a wedding. Drank quite a few cups of beer but somehow got fever the next day. Took medicine and slept but just couldn’t shake off the fever. Soon after, sore throat came and boy did that hurt like a bitch. It got inflamed right off the bat and it took my dumb ass 4/5 days before I took the L and went to the doctor. I could literally feel my muscles leaving my body; thankfully up till now (mid Aug) I’ve been putting in my exercises to keep fit and gain back that muscle mass. While I tested negative, I was pretty sure it was Covid knocking on my door again, and it is NOT something I want to experience for a third time.

Work

August was quite a busy month with just things happening every day and many tasks to complete. I’ve a presentation to senior management at the end of August and at the beginning it was just me staring at the blank deck with nothing coming out. I wonder if it’s due to my inexperience in presenting in this domain, or just my inability to fluff my way through. Also as I’m already into my 3rd month, it was natural for me to be delegated more work; my boss is actively managing the gear, turning up the heat to push me out of my comfort zone. How much workload can I take on before I see a deteriorating trend in the quality of works I produce? In any case, I am grateful for this opportunity to grow my personal self, but hope that I’ll be strong enough to weather whatever fuck-ups that come my way, as it always will be.

On an optimistic note, while it seems like some days can be too stressful and overwhelming, the fact is that the day will always pass, and the stress will dissipate. :)

Renovation/Wedding

After talk (last month) about finding Interior Designers (ID) that may usurp Diana (our current preferred ID) as the new #1 ID, it did not come to fruition, as the chemistry we had with Diana was something we couldn’t find at other IDs. We’ve just signed the contract with her (& paid 10% deposit) and I think there’ll be no regrets on this.

We also made quick work of shortlisting the photographers (PG) and videographers (VG) because there may be a chance that they are unavailable for our wedding date (which is about 13 months in the future). While I think it is way too early (my fiancé doesn’t think so), there’s no downside in securing these slots early (happy wife happy life), other than the non-refundable 50% deposit though…

Conclusion

It’s now been 1.5 years writing this monthly journal (from Feb 2021), and I think it has been a right decision. Looking forward to hit the 2, 3, 5 year mark. Consistency is key, and it's a habit that will pay off handsome rewards in the long term :)

Also appreciate my readers from Seedly for end of June 2022. Thank you!

Mainly, I just want to spread my (amateur) knowledge about investing and to treat this as my public journal. May my newsletter stand the test of time; hope you continue reading this even after 5-10 years, as I’ll be writing still :)

This doesn’t have to be said obviously but I appreciate each and every single one of you who read thus far. Feel free to connect with me and talk shop (equities and crypto or even personal finance), my door is always open.

See you next month.

Cheers,

Joey