Equity Portfolio Breakdown

% Value: Value as % of my portfolio

% Cost: Cost as a % of my total cost invested into equities

This table simply visualises the divergence between my investment thesis and the current market expectations of the company. No hard rule on % cost allocation for stocks yet, nor a threshold where I will trim them.

Equity Portfolio Performance

Historical Portfolio Returns (top); Cumulative Portfolio Returns (bottom) - Since new brokerage.

Monthly Portfolio Returns

CAGR Performance

Note: CAGR for my portfolio is calculated as:

(market value of portfolio including cash / total cost) - 1

The CAGR returns are compared in the above table instead.

Crypto Portfolio Performance

* Charts start from end of November 2020 when I started recording my crypto portfolio. Summarizing:

2020 performance: 2.7x-ed my portfolio

2021 performance: 5.5x-ed my 2020 portfolio

Lifetime performance: 6.33x my cost

Lifetime result:

- Achieved 1.57x of BTC performance (6.33/4.04)

- Achieved 0.45x of ETH performance (6.33/14.12)

When all you had to do is to be in BTC or ETH… but not me, a clown. Very hard to keep pace with the majors.

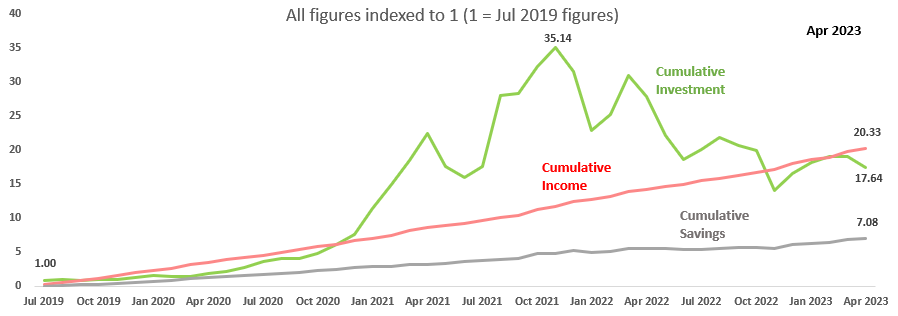

Net worth growth

If there’s only one metric that you can apply to your financial life, I believe that would be net worth. If you’re investing, perhaps under 5% of your gross income for investments, it’s a little hard (compounding considered) to eventually make a dent in your net worth.

To read this chart:

I’ve received ~20x my Jul 2019 net worth, in terms of income / bonus.

I’ve made my money work, and my net worth now is ~17.6x my Jul 2019 net worth.

I’ve accumulated savings of 7x my Jul 2019 net worth.

Red line is an extreme example; Anywhere between grey and red is acceptable, since you’re supposed to compound your savings, and not your income (i.e. you don’t spend anything). Onwards and upwards!

Thank you for reading my monthly journal of my portfolio. I keep it very real and authentic because nobody can buy the bottom and sell the top. Life is full of mistakes and writing this helps me identify what went wrong and how I can improve. Besides investment I also talk about my life (also a journey) as I live through it.

Catch the monthly update of my personal and investing life by subscribing below.

Equities portfolio review

Portfolio movements

Buys: TSLA (x2), SE, SNOW, DDOG, CRWD, NET

I added a fair bit, though am wary of the saying “Sell in May and walk away”. There’s still an element of FOMO in my purchase decisions, I must admit, but in my view, the next 3-6 months would prove to be the best times to deploy capital. The markets are forward-looking, and I think 1-2 quarters down the road, we’ll see be able to observe the consumption recovery (if any) from the hyper-scalers themselves (for cloud / consumption based), or large-caps (Apple, Tesla for discretionary spending), as well as mid-caps (e.g. SaaS). It’s currently a mixed bag, with much uncertainty around the economy, but that should become clearer in the next 2 quarters.

Sells: NVDA

I wanted to get more cash (to buy dips), and given that Jim Cramer tweeted positively about Nvidia near its historical highs, I sold another tranche. I think that it is already richly valued, and so not very optimistic about forward returns at that price. I’ve sold the final tranche of NVDA at about $277 around mid-April. Regardless, this company gave me good returns, and I’ll be sure to revisit when prices are more reasonable, and if not, I’ll simply move onto my next investment idea.

Commentary

After the equities rally that saved my portfolio, the market is yet again on inflation & Fed watch - Will the lower (or higher) than expected inflation moderate the Fed’s willingness to keep raising interest rates (in an attempt to rein inflation), or will the Fed stand its ground to show that it’s still a credible institution?

Personally, I don’t think inflation and the Fed are worth watching anymore (the time to watch it was during 2022), since the markets are constantly pricing in what the future holds. What I mean, is that markets on Nov 2021 were pricing in interest rate hikes, which marked the end of the Covid-19 bull market. Markets on Nov 2022 were pricing in interest rates being at x%, with inflation still taking its own sweet time to subside. Markets on Apr 2023 are currently pricing at most 1 or 2 more 25bps rate hikes, and no rate cuts at least until the later half of 2024. Inflation readings also appear to be cooler than expected these past 1-2 months.

In this situation, will things get any worser (before they get better)? With about 5% in interest rates we’ve got the SVB crash and a temporary market panic. What would 5% for 1 year give us? That’s the worst case scenario.

The base case, is that nothing happens, and markets would rise on no news (which is good news). We can simplify the road forward in an IF-ELSE statement:

IF (No unfortunate events occur):

Continue purchase of equities

Else (>0 unfortunate events occur):

Continue purchase of equities, but add more during times of panic

That’s basically it.

Buy if nothing is happening; Buy more if everybody is losing their minds.

Thanks for coming to my TED talk.

In my opinion, you DO NOT want to go the remainder of 2023 WITHOUT spare capital to deploy. The reason is quite simple; Markets (major indices) tend to bottom AFTER rate hikes (or even slightly after rate cuts), but individual stocks do their own thing, and are generally influenced by consumer sentiment. If companies can tide through the recession (if it ever comes), then they’ll likely want to capture more market share, by spending more sales dollars to capture more market share.

This is of course, not financial advice.

In other news, this was what I thought of earnings from TSLA, ROKU, and NET.

Tesla

They’re still growing at scale, though the actual # of vehicles sold decreased sequentially. However, they seem hell-bent on aggressively manufacturing cars, and have even a brand-new model that they’ll unveil in the near future. That’s on top of the delivery event of CyberTruck, set to take place in the second half of 2023. In terms of EVs, I think market share will continue to maintain (or be ceded to legacy ICE competitors), and with the absolute size of the pie getting very, very large, the runway for this is pretty much set of the next 5-10 years.

In terms of their storage / energy solution though, I believe this is where the S-curve is currently happening, since I don’t think there’s another competing solution out there that makes better batteries or stationary storage than Tesla. Happy to continue owning a EV-first company in a world that will get increasingly electrified.

Roku

Topline figures (e.g. streaming hours, active accounts) also grew sequentially, showing strength, with TV (& Player) sales still going strong in US (#1 in US, with 38% of units sold in Q4, larger than next 2 OS combined, which are Google and Amazon), as well as in Mexico and Canada too. Sports was added not long ago, and I think this will continue to be a funnel that accelerates cord-cutting behavior in established countries (e.g. old people will want to watch sports on their TV, young ones want streaming services; Roku is thus best of both worlds).

The Roku Channel (their AVOD channel) is still growing rather quickly (85% YoY), and is a top 5 channel by active account reach and streaming hour engagement. This provides a strong inventory of ad supply that advertisers can easily tap on, with Roku’s rich first-party data. That is, once certain verticals recovered from the current lull, that is. In summary, this quarter looks good, but it’s still a long way before Roku can re-grow into the beast it once was.

Cloudflare

They released their earnings in the final week of April, and while I’ve had time to digest it, I haven’t really went through the earnings call, and so I’ll provide clearer thoughts next month. I bought the post-earnings crash, so I guess that says as much.

DCA investments

Endowus

I’ve recently chanced upon in one of Endowus’ routine marketing emails that Blackrock funds are now available within the platform for us to invest our monies into. To my delight, the S&P 500 tracking fund (Ticker: IVV) is available for customers to invest. This was great news, as I was originally stuck with LionShares Global, which, was a little higher in cost than usual. Compared to Blackrock, I was able to save around 0.27% in absolute costs (0.35% for LionShares vs 0.08% for Blackrock). I switched into the Blackrock fund, which explains the dip in my chart. Performance chart below. Still positive YTD so I’ll take it.

URA

I’ve discovered another chart that can better show my returns in URA, and it also provides a handy comparison to SP500, which is an index that I would love to outperform over the long-term, though it’s underperforming so far…

Crypto Portfolio Commentary

Aaaaand we’re above Michael Saylor’s breakeven price. A continued bout of bullishness persisted into April, sending the orange coin above the big, round figure of 30,000 sweet American USA dollars.

While everybody dunked on Saylor, he stayed true to his one vision, buying more Bitcoin. And oh, he sure did. As of 13 Apr, MicroStrategy’s Bitcoin holdings stands at 140,000 BTC at an average price of $29,803. For what its worth (& whatever the outcome), this guy deserves respect for sticking to his guts. His entire portfolio is now in profit, which is way more than I can say for my own portfolio (looking at you Doge).

There is no second best.

Regardless, 30k USD has been a long time coming, because that’s also well above my breakeven price for hosting my 8 Bitcoin miners. At an average of ~0.06 per month, 30k USD will net $1,800 USD, which is more than enough to pay for the facility costs.

More on that in the Mining section below.

The month of April also welcomed the Shanghai upgrade, which allowed Staked ETH to be queued for withdrawal. As you may recall, ETH had officially transitioned into proof-of-stake (PoS) sometime last year, but the platform had already allowed bigger players to stake their Ethereum directly with on the Beacon chain (requiring 32 ETH). These players (among others) can now withdraw their staked ETH, along with their rewards. The pic below shows the current queue (as of 13 Apr) for withdrawal and deposits, and shows that despite the news being peddled around as a sell event, the amount of ETH deposited is slowly catching up with the ETH queued for withdrawal, and has not stopped going up since the Shanghai upgrade.

Since the upgrade on 630PM EST on 12th April, price went from $1.9K to $2.1K in just two days (as of writing on 14th Apr). Talk about one night in Beijing Shanghai…

Holdings

Portfolio holdings as below. Mainly, I’ve added another NFT (this time in Solana), rotated most of my core gaming position into another coin, and witnessed a potential bull narrative for a L1 ecosystem. Let’s dive in.

Solana Mobile

Solana announced on 13th April that their flagship Web3 phone (powered by Android) will be available for order. The phone (named Saga) is wholly built based on Web3 principles (i.e. security conscious, crypto-first). Read this thread for more info.

Given the prevalence of the mobile generation (i.e. everybody on their phones all the time), it is only logical that to onboard the next 10, 100 million crypto folk would be based on mobile ecosystems, which the mobile generation find native. Imagine buying a NFT as you commute to meet your friends, or swapping coins on the go. All without the hassle of logging into your MetaMask or wallets that are situated in your web browser. Sure, security concerns always be there, but to have a fully functional Web3-ready phone in your pocket really unlocks the touchpoints future consumers can have with the crypto ecosystem (instead of just using your laptop/computer).

The reason why I think this move is bullish, is simply because Solana is doing the one thing that its competitors (e.g. Binance Smart Chain, Ethereum L1 + L2s) aren’t doing. Solana (AFAIK) is the only player in the crypto ecosystem that has designed and produced a mobile phone for crypto. True, it may be geared towards the Solana ecosystem, for sure, but the gamut of activities enabled by the phone that was previously unachievable on-the-go is mind-blowing.

When the next wave of retail arrives at the scene (and they will, you can count on that), how would they want to display their status symbols (e.g. the next BAYC, or CryptoPunks) to their social circles?

You’re not going to bring a laptop to a social event, are you?

https://twitter.com/Nstr_tj/status/1647630560632750080

It does feel like the Saga will sell itself, but of course the actual usability will have to be seen - whether it’ll hold up to the standards of our TikTok generation.

I’m bullish the coin, obviously.

NFTs

Over the month I made 2 moves in NFT projects (where I felt it showed promise): Kanpai Pandas, and Mad Lads.

Kanpai Pandas

Kanpai Pandas is a NFT project, with NFTs available for purchase across 7 chains (Ethereum, BNB, Polygon, AVAX, Fantom, Arbitrum & Optimism). The final 1,000 NFTs will be available on Solana for purchase in the near future. The project is a fine example of a Web3 brand-building, by injecting real-world utility though exclusive partnerships and/or sponsorships with athletes. It owns a permanent VIP suite (good for 15 years) at a Las Vegas stadium (for NFL, Super Bowl, even concerts from Red Hot Chili Peppers). They’ve recently partnered with boxing athletes that will show Kanpai Pandas apparel in the matches that they’ve appeared.

There are many more examples, but I think that the founder has put in tremendous effort in making all these Web2 connections, and putting the brand out there for the masses. This says much more about their longer-term potential (based on brand) than their current floor price. More about the project here. More threads (if interested) here, and here. I’ve added another NFT, and so now I own 3 pandas.

Mad Lads

Mad lads are a NFT project based on the xNFT framework by a famous and OG Solana developer, Armani Ferrante. The “x” in xNFT stands for eXecutable, which represents tokenized code representing ownership over its execution. It compares itself to current wallets, where you would need to sign into each and every UI for whatever crypto activity you’re doing, such as staking a NFT, viewing NFT listings, or managing your DEX margin trading accounts. In xNFT, you could manage them all in a single interface, without ever leaving that ‘wallet’ or walled garden.

I’m not the most tech savvy person out there (though I’m reasonably decent), but it does feel like this framework has broad-based support by the major players within the Solana ecosystem (and to a certain extent, anecdotally, ETH as well). Backpack is the 1-size-fits-all wallet that purports to achieve xNFT’s intended objective.

Mad Lads are currently the “face” of this backpack solution, and thus when retail investors do flock back to crypto, they will naturally gravitate to the killer wallet, which can do anything and everything crypto, all in one interface.

This is particularly welcoming in the Solana community, to be honest, ever since DeGods left the Solana ecosystem for “greener” pastures (DeGods to ETH, Y00ts to Polygon). It appears that Mad Lads are trying to fill the hole left by its predecessor. Together with the Saga phone, I’m not sure how much more bullish I can be with this ecosystem. Compare Solana with Ethereum/L2, while there are many advantages of using the Vitalik-Chain, the brand of Ethereum (especially together with L2s) is quite fragmented to me, and is can sound quite technical to potential newbies in the near future. 1-2 years down the road, Ethereum will still likely cost ~$10 to perform a transaction, but Solana only requires a fraction of a cent. AND you can enjoy a seamless experience through Saga phone.

What’s not to like? Here’s a thread on why Mad Lads are taking over Solana by storm.

My NFTs purchased below.

The reason behind buying a female gender trait (as opposed to a male) is based on my investment opinion. The floor price of female Mad Lads appear to show a higher beta, and thus we can expect Mad Lassies to go for much higher, assuming this project actually takes off in the long run.

Remember, my goal is to accumulate more of BTC, ETH and Solana.

And NFTs are one key way to do it.

Doge

At the start of the month I started shifting majority of my spot position in Vulcan Forged (PYR) into DOGE. Seeing as how Elon and Doge is forever inter-twined (see the logo for Twitter), it is quite likely that there would be much more positive narratives going for the doggo-coin than negative.

Let’s step back a bit. Vulcan Forged is an established non-fungible token (NFT) game studio, marketplace, and dApp incubator with 10+ games, a 20000+ community, and top 5 NFT marketplace volume. It has also partnered with several other brands/chains, including Atari (gaming company), Polygon, and Binance Smart Chain.

I originally liked it because it’s more of a picks and shovels kind of thing; enabling other games to also leverage on Vulcan’s marketplace to transact. That said, it could be a mix of the current ranging market, as well as the presence of new narratives that made PYR lose its luster (relative to other tokens).

I have also sold what’s remaining of my Merit Circle (MC) position, which was originally a gaming guild. If you recall, a gaming guild exists to farm P2E games, allowing it to leverage on their larger bankroll (compared to retail) to get the rewards faster, by way of purchasing expensive / premium in-game items. This strategy famously collapsed with the downfall of Axie Infinity from the 2nd half of 2022.

Merit Circle then pivoted into a gaming DAO, using the MC tokens in treasury to ‘buy’ stakes in crypto games which showed promise, in hopes of riding the wave to riches, much like the VC who invested in Axie Infinity.

Relatively speaking, I felt that the Doge narrative, compared to the MC/PYR track, certainly has more legs (because Elon will pump it till the end of time, and it could even be a cryptocurrency on Mars, lol). I’ve converted some of my PYR into Doge, and my MC position into USDC.

Let’s just say, it’s not difficult to make such an iconic meme go viral again. Edit: I trimmed half my position to fund my endeavors elsewhere, namely on Solana NFTs.

Mining

The increase in mining difficulty has made it harder to compete for Bitcoins when mining it with other players who can constantly get more miners online. My lifetime mining output is 0.91 BTC (since the first miners went online on Dec 2021), and I hope to get it above 2 BTC before my miners are forced to retire due to wear and tear.

Life

A busy April, but I was able to say “I Do” to my beloved partner, becoming husband and wife in early April. In the grand scheme of things, I think work ranks at the bottom, and so any events or activities that you have in your main “life” should deserve a higher priority. My solemnisation was one of them, and it was indeed a magical experience. Now I get to call my partner my “wife” and I don’t have to consciously call her by another term (partner/fiance). How great :)

April was also when our house renovation officially started, a whole 2 months after we collected our keys, as it included defect checks (the arranging of appointments took the longest). Nonetheless, everything is starting to progress, and I look forward to write this article in the comforts of my new home soon enough.

Last but not least, I also started a Data Engineering course with IBM on Coursera, in hopes that I can make a slight career pivot (from an analyst to an engineer) sometime next year. Career changes are always not easy (you’d have to deal with interviews whilst not letting people know you’re doing them; the serving of notice tends to be a little bitter, since your boss will surely want you to keep staying at your current role). That said, it’s where I want to go and where I think my strengths will shine.

My current role requires a lot more presentation skills than I anticipated. While that is an important skill, it’s not something I’m inherently good at, and I expect my eventual skill level to not be as high as e.g. someone who’s a natural salesman. That’s just life. Data Engineers appear to earn more too, though, so there’s that.

Conclusion

Thank you again for reading thus far. It’s really heartwarming to see consistent views coming in (and I’m not trying to increase them), and that is motivation enough for me to keep on writing.

Cheers and I’ll see you next month,

Joey